End-to-End of Accounts Payable Process: From Start to Finish

Accounts payable departments play an important role in every business. It is said that 80% of invoices are never paid on time or at all. This poses a huge challenge for businesses that need help managing their cash flow. Many companies have automated the workflow for accounts payable process over the past few years, and this has helped them be more efficient at managing their accounts payable process. A lot of organizations have realized that this can help achieve better financial results and save valuable time, which could be put to better use doing other profitable tasks in the business.

What is an End-To-End Process of Accounts Payable?

The end-to-end process of accounts payable (AP) is the process of creating, sending, and receiving invoices. The aim of end to end process of accounts payable automation is to reduce manual work and save time by automating the entire process.

This process includes:

- Analysis of Accounts Receivable – The first stage of accounts payable involves analyzing the accounts receivable and determining which invoices need to be paid.

- Payment – In this stage, you will use your bank account or cash management system to pay out funds owed by vendors. If there are any discrepancies in how much was paid or if something went wrong during payment processing, then you can investigate further by reviewing transaction records with your financial advisor or accountant. This should be done before deciding whether it’s worth continuing with this vendor relationship (which may require some sort of resolution).

- Resolving Disputes – If someone has filed an objection against one of these payments (for example, because they believe their product was not delivered), they will need to resolve the dispute before proceeding further into this cycle.

Steps in a Basic End-to-End Process of AP Workflow Process

Understanding how accounts payable works is key to knowing how your business operates. It’s also a great way to understand yourself better and make better decisions about what you do for a living. Accounts payable is an important part of any business, but it can be confusing at first if you need to learn the basics of the system.

You will have to create a purchase order at the beginning of an accounts payable process. A purchase order is used to request goods or services from suppliers and suppliers will use it to send their products or services to you. When the purchase order is created, it will be sent out for approval by your company’s finance or accounting department.

Once it has been approved, this step in your accounts payable process is complete and you can move on to the next stage: receiving inventory items tracking them until they are delivered, invoicing customers for payment; approving final payment before sending bills out for payment etc.

A detailed workflow process of a basic end-to-end AP process looks like this:

Invoicing

Invoicing is a key step in the end-to-end process of accounts payable. An invoice is a document that is created to record all the details of a transaction between two parties. It is sent to the customer/supplier and contains information about goods purchased, services rendered, and other charges incurred.

Invoices are important for accountants because they help them keep track of payments received by their clients as well as their own expenses. The invoice will also be used to determine whether an expense was charged correctly or not and if it needs reimbursement from your client’s company (if sold on credit).

The invoice is sent by your supplier to you when they provide you with goods or services on behalf of their client (the company that commissioned them). An invoice is also sent if you pay for goods or services as part of a contract between you and your client, such as a sales order.

Your supplier will use an invoice template or document to send out invoices. You can create your own invoice template or use one of the templates available online or offline using Cflow. If you want to avoid creating your own, there are many tools that allow you to upload an existing invoice into their system.

Also, the accounting staff reviews invoices to ensure they contain all necessary information, such as account numbers and prices. The accounting department then determines whether or not each invoice has been paid by checking both their internal records and vendor accounts.

Accounts payable collection

Accounts payable collection is the process of collecting accounts receivable from creditors. It involves ensuring that creditors are paid on time and in full and minimizing credit risk by collecting payment when possible. In order to do this, you need to be able to identify your customers’ needs and communicate them effectively through your sales channels (i.e., email marketing).

The receiving of payments is one of the most important steps in the accounts payable cycle. It ensures that all invoices from customers are received and processed properly so that you can get your money from them as soon as possible. The process of receiving payments involves the following steps:

- Receiving invoices from customers;

- Processing the invoice within a certain time frame;

- Clearing payment through bank accounts or cheque book etc.;

- Sending notifications about the outstanding amounts due to suppliers/vendors etc.

Payment processing and authorization

Payment processing and authorization are part of the accounts payable process. They are automated in most companies, but they can be manual or semi-automated if necessary.

Payment processing is the process of receiving and paying invoices. Typically this involves collecting information about an invoice from your supplier. You need to determine if you have sufficient funds to pay for it (i.e., “the cheque is good”), and verify that there are no outstanding bills (i.e., “we are not past due”). Then send payment instructions back to our suppliers so they can take care of their end of things as well.

Companies also use credit memos. This is when they need funds immediately but don’t want to wait until the end of their fiscal year to pay out invoices due within 30 days after receiving them via mail or email. Credit memos allow businesses access right away without waiting until tax season comes around again.

Finally, payment status reports are created that show the status of all payments made and do not need to be generated by the accounting department. This report will show the results of all your past payments, including any late fees or penalties. You can categorize the reports such as “Bill Pay History” or “Merchant Credit Limit History,” which will help you keep track of all of your previous payments and when they were made.

Importance of End-to-End Process of Accounts Payable

Accounts payable is an important process which helps in handling the payments of vendors and clients. It involves payment of vendor bills and statements, customer invoices processing refunds etc. The end-to-end process of accounts payable ensures that all these transactions happen seamlessly without any errors or delays.

The importance of an end-to-end process must be recognized because it ensures that everything related to this phase of accounting has been completed properly and consistently from one department to another. This means that if there are any mistakes or inconsistencies within this phase, it will affect all other parts of your business as well.

Eliminating the need for manual data entry

Manual data entry is time-consuming, can lead to errors, and is costly. Organizations also need help to keep up with their accounts payable process as they grow in size and complexity.

Automation of the accounts payable process can reduce cost and time to payment settlement by eliminating manual data entry. Automation allows organizations to automate tasks such as creating invoices and sending them out automatically. No one has access to these files unless they need them for a specific task (such as submitting an invoice for payment).

Ensure accuracy and consistency of the process

The process of Accounts Payable is a key part of any company’s end-to-end process. It ensures accuracy and consistency of data entry, payment processing and record keeping. The following are some important points that should be kept in mind while setting up an Accounts Payable system:

- Ensures accuracy of data entry by ensuring that all payments received go through the correct account number depending on the type of payment received (i.e., cash or cheque).

- Ensures consistency in data entry across all departments so that there is no confusion among employees about who should enter what when it comes to recording customer invoices/credits and payments made against those invoices/credits etc., which helps reduce errors during processing and reduces turnaround time for customers as well as increase efficiency levels at BPOs etc..

Ensuring timely and accurate payment processing

Payment processing is an important part of the end-to-end process of accounts payable. This process ensures that payments are made, in a timely and accurate manner, at the lowest cost possible for your company.

- Payment processing is done in a timely manner: The time it takes to process payments varies based on your payment method. For example, if you use traditional checks or direct deposit from your bank account, it may take several days before receiving them. If you use online bill payment services such as Paypal or any other online payment modes then this will be immediate. But they can also be more expensive than using traditional checks or direct deposits as they charge fees per transaction which can add up quickly if many transactions are being processed each month.

- Payment processing is done accurately: When managing these systems, it’s important that everyone understands how each step works so there are no surprises when things go according to plan. Especially when dealing with sensitive information like customer details etc. In addition, there should also be clear guidelines around what constitutes acceptable quality standards so everyone knows exactly what they need to do before sending out any invoices, etc.

Enhancing customer experience

Customer experience is the key to success. It can be enhanced by providing timely and accurate information, reducing the time taken to process payments, and ensuring transparency in the process.

In a nutshell, end-to-end payment processing helps you provide better customer service by improving their experience with you.

Challenges in the End-to-End Process of Accounts Payable

- Fraud. Accounts payable is the primary entry point for fraud, and the likelihood of it occurring is higher than most other processes.

- Data loss. Once your data has been transmitted from one system to another and then into a third party’s system, it is at risk of being compromised or lost completely. This can happen either through human error or an attack by hackers or viruses (a big fear among many organizations).

- Non-compliance with regulations/laws/contracts by vendors! If vendors do not comply with regulations such as those governing privacy rights, they could get fined thousands of dollars per violation–and this cost will be passed on to you!

Automating the End-to-End Process of Accounts Payable

Accounts payable (AP) ensures that customers receive the correct invoices and payments, which ultimately helps you achieve better financial results. However, this process is time-consuming, complex, and error-prone. If you want to automate this process so that it becomes more efficient and accurate, then here are some tips on how you can achieve that:

- Use a cloud-based solution. Cloud-based applications are the most common way for businesses to automate accounts payable processes, as they’re easy to set up and customize, allowing you to quickly implement automation without worrying about how it’s going to work on your particular system.

- Integrate with your accounting system. If you’re using accounting software like Sage 100 Accounts Payable for Mac or QuickBooks Online for Mac, then it should be easy for you to integrate into those systems so that all of your transactions get automatically processed through them instead of manually entered into ERP (enterprise resource planning) software like Cflow and other ERP tools.

- Integrate with ERP systems – if possible some companies may have one main ERP that handles all financial operations while others have separate systems that handle different types of data processing tasks like invoicing and payables processing respectively. However, regardless of what kind of setup they have in place, there’s always room for improvement by incorporating automation capabilities into their existing architecture, which will help reduce manual errors while improving efficiency overall.

How Saas Can Help End-to-End Process of Accounts Payable Automation

SaaS can help the end-to-end process of accounts payable automation by automating the end-to-end process of accounts payable. SaaS is a cloud-based, software-as-a-service solution that allows companies to pay bills and manage their finances in one place. It provides a suite of tools for managing all aspects of finance, including invoices, payments, reports, and more. All are seamlessly integrated with your existing ERP or CRM systems so that you can make changes quickly without having any downtime on your business operations.

SaaS automation can be used for various purposes including:

- Automating processes such as sales orders or purchase orders (POs)

- Managing supplier relationships through sending messages or emails based on specified triggers such as PO date/time stamping

- Sending reminders about due dates for outstanding invoices/POs

Change How Your Customers Receive Invoices and Payments with Cflow

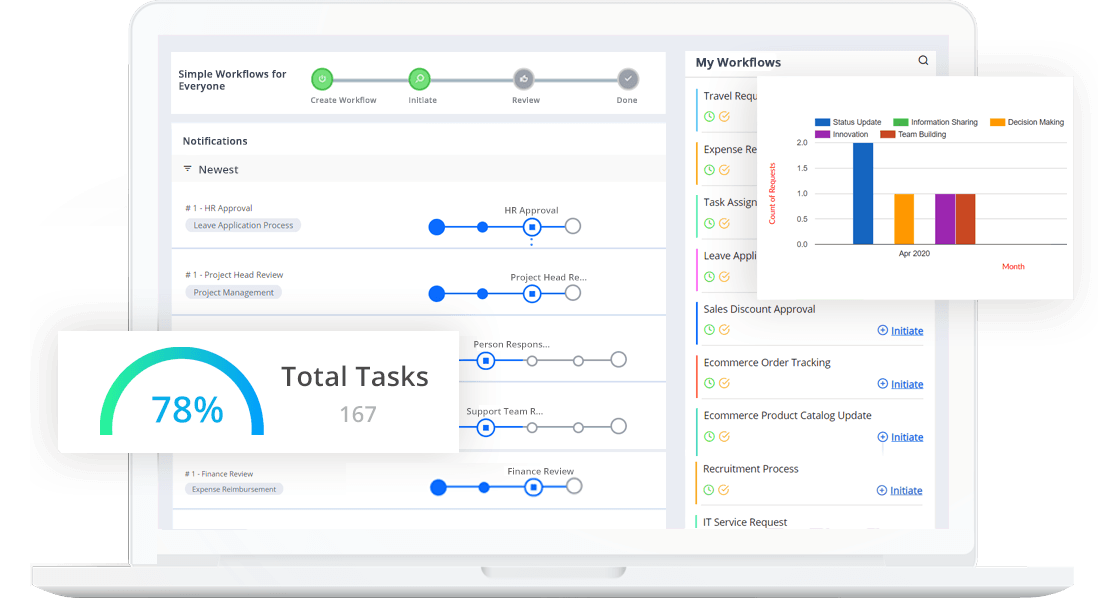

As mentioned before, SaaS workflow tools come in handy when automating your accounts payable processes. You need the right tool, like Cflow, to help your business become more efficient. Cflow is a no-code workflow automation tool that provides end-to-end solutions for all your process needs.

Invoices and payments are sent via email. The recipient’s name is auto-populated in the subject line, so there is no need to enter any information other than their email address when they receive your invoice/payment.

With Cflow, you can integrate a third-party services provider that provides an online invoicing tool that allows you to send out invoices from your account payable management system (APMS). This APMS can be set up completely with Cflow. The recipient’s name will be auto-populated when they receive their bill; no additional data needs to be entered at this point in time.

The process for receiving payments is similar: The customer receives an email from you asking them if they would like to pay within 24 hours or longer, depending on your preferences set within APMS settings. Once someone has accepted, then both parties can log into their respective accounts through APMS, where payment details will be entered. All these you can manage using our comprehensive tools in Cflow.

Closing

To sum up: the accounts payable process is a key part of your business operations. Some companies use this tool to track payments, while others use it as an opportunity to automate processes. Regardless of the type of company you run, understanding how your accounting system works will help ensure that cash flow remains healthy. With the right tool, you can automate many of these processes and save money and time. Ready to explore Cflow? Sign up for the free trial.