Understanding the Why-How-When of Invoice Approval Workflow Automation

Invoice approvals are an integral part of every business, irrespective of whether they offer products or services. A clear and transparent invoice approval process is a must for maintaining good vendor relationships and accelerating invoice approvals.

Manual, paper-based payment approval processes are prone to errors, duplication, and delays. The invoice approval workflow is made up of several repetitive steps that can be effectively automated with workflow automation software.

Businesses cannot afford to have subpar invoice approval processes without facing consequences like unanticipated liquidity shortages, unexpected cash crunches, and inaccurate cash flow forecasts. Paperless invoice approval systems offer better control and visibility into the invoice approval process and avoid delays in approval.

Also Read: What is workflow in accounts payable

Invoice Approval Process at a Glance

Accounts payable is a critical business function that affects the business bottom line directly. Whether it is a single person accounting operating accounts payable or a large finance department handling financial transactions, a clear mapping of various steps is essential for streamlining the accounts payable process. The invoice approval process is at the heart of the accounts payable function.

If you want your business to succeed and establish reliable vendor relationships, timely vendor invoice approvals are a must. The first step to optimizing the invoice workflow is to familiarize yourself with the workflow. What is the invoice approval workflow? It is a checklist of steps/activities that need to be undertaken to validate and pay an invoice.

The invoice approval includes steps like information verification and approval before finally submitting the payment. At the end of the invoice approval process, invoices will be cleared and payment will be made to the appropriate parties.

The invoice approval process includes the following activities –

- Verification of the invoice data by comparing it against the data in the receipts, progress reports, purchase orders, and other data

- Request for additional information or clarification in case of any discrepancy

- Request appropriate signatures to approve the invoice

- Process the invoice payment and pay the money owed.

The invoice approval process begins when the buyer receives the supplier invoice. Once received, the invoice is sorted into the appropriate category and forwarded to the respective stakeholders for approval. Small and medium businesses usually have a member of the admin team to process invoices, while enterprise businesses have the accounts payable department to take care of invoice approvals.

Invoices are categorized into two types

The ones that have a purchase requisition or purchase order, and the ones that are not associated with any purchase order or request. The payment approval workflow comprises the following steps:

Creating an invoice

For creating an invoice, all the relevant information should be captured and recorded in the document. Timely approval of invoices requires the capture of relevant information for payment, like total cost, number of units, and cost per unit.

Validation or PO matching

The next step of the process is to categorize the invoice based on the type of purchase. The validation step identifies and links other related purchasing documents like order receipts, purchase orders, purchase requests, and goods received notes.

Define exceptions

Invoices that do not go through the validation stage due to any discrepancy or missing information need to be forwarded to specific people who can fix the errors or furnish the missing information. Once the discrepancy has been addressed, the invoice is rerouted for approval.

Routing approvals

Validated and matched invoices are routed to the appropriate approver. The approver is chosen based on the information mentioned in the purchasing document, such as the PO number, department, or requestor name.

Processing payment

Approved invoices are forwarded to the finance team for further processing. Invoices that are approved are sent for payout, once payment is complete the invoice can be closed.

Why should you Automate the Invoice Approval Process?

The need for automating the invoice arises from the inefficiencies of manual invoice approval. Traditional invoice approval processes are filled with a number of inefficiencies and process gaps. Organizations that use manual invoice approval processes experience delays and fraudulent practices.

Here are 5 reasons why you should automate the invoice approval process:

1. Unexpected delays in approval

Conventional invoice approval processes are characterized by delays in the review and approval of invoices. Manual processes are also riddled with bottlenecks

2. Lack of visibility

the stakeholders do not have visibility into the status of the invoice in a manual process. The lack of visibility into the status of invoices causes delays in approvals.

3. Lack of transparency

Manual processes are not standardized and depend more on human intervention. This decreases the transparency in invoice workflows.

4. Long approval cycles

any process that is driven by human efforts is ridden with delays and long approval times.

5. Excessive paperwork

Manual processes use a lot of paper-based documentation. Loss or damage to paper documents causes delays in the approval process.

Manual invoice approvals are ridden with all of the above challenges that slow down invoice approvals. An electronic invoice approval process addresses all these challenges and improves the speed and efficiency of invoice approval.

When should you Automate the Invoice Approval Process?

There are several reasons why you should automate the invoice approval process. Organizations looking to improve the efficiency of invoice approval and eliminate errors and frauds from the process must consider invoice approval automation.

Most organizations are still using archaic manual approval processes mainly due to the simplicity and minimal costs associated with manual workflows. Finance and procurement teams are so used to working on manual systems that they do not want to step out of their comfort zone and adopt automated invoice processing approvals.

When should a business consider automating its manual processes? There are some indications in business operations that must be taken as a sign to automate the invoice approval process.

Here are signs that indicate that the invoice approval process must be automated:

1. Time wastage

When too much time is wasted on reviewing and approving invoices, it is time that businesses consider automating their invoice approval process. Business processes comprise several repetitive tasks that are time-consuming and tedious. Accounts personnel spend several hours of their productive work time on routine, low-value tasks like invoice matching, following up on invoices, and tracking missing documents.

2. Misplaced documents

In large organizations that follow manual invoice processing, the issue of misplaced or damaged documents is very common. Accounts personnel waste a substantial amount of time searching for missing documents. Paperless invoice approval systems can relieve the team from the additional work of finding missing or misplaced documents. When incidents of missing or damaged paper documents are on the rise, organizations must consider digitizing the documentation workflow.

3. Delayed approvals

When invoice approvals are delayed, payments to vendors are subsequently delayed. Delayed payments to vendors affect vendor relationships adversely. This situation can get worse in large organizations where multiple approvers are involved and the visibility into who is responsible for which approval is blurred. Consistent approval delays are a clear case for invoice approval automation.

4. Exposure to fraud

One of the biggest challenges faced in manual invoice approvals is the risk of fraud and duplication. Manual workflows offer very little oversight and visibility into the accounts payable process. Compromised visibility opens up gates for fraudulent practices in invoice submission and approvals. Duplicate or fake invoices are on the rise.

Automating the invoice approval process is a tested way to steer clear of fraud. When the accounts payable department faces several instances of fraud in invoice processing, it is time to automate the approval process.

5. High error margins

Human errors in invoice processing can prove to be very costly for the business, resulting in invoices being underpaid or overpaid. Even errors in bookkeeping result in losses for businesses. High error margins in invoice processing not only result in loss of money and disgruntled vendors but also affect the auditing process adversely. When invoice processing errors are on the rise, it is high time you automate the process.

6. Missed cost-saving opportunities

Payment discounts are often offered by vendors to buyers who make early payments. When invoices are processed manually, buyers often miss out on such cost-saving opportunities. Automating the invoice processing workflow ensures that payments are done on time and buyers can avail of the early payment discounts on pricing. If you have missed payment deadlines and cost-saving opportunities, then it is time to consider automating invoice approval.

When your business faces any or all of the above issues in invoice processing, it is time to consider automating the invoice approval process and payment approval process.

How to Automate the Invoice Approval Workflow with Cflow?

Now that the why and when of invoice approval automation are clear, it is time to look at the “how” part of invoice approval workflow automation. Even when you have an electronic invoice approval process, if the rest of the business processes are weighed down by paper-based manual processes, then automating invoice approval workflows is not going to be useful. Automating the entire procurement workflow provides significant benefits to the business, rather than just invoice workflow automation.

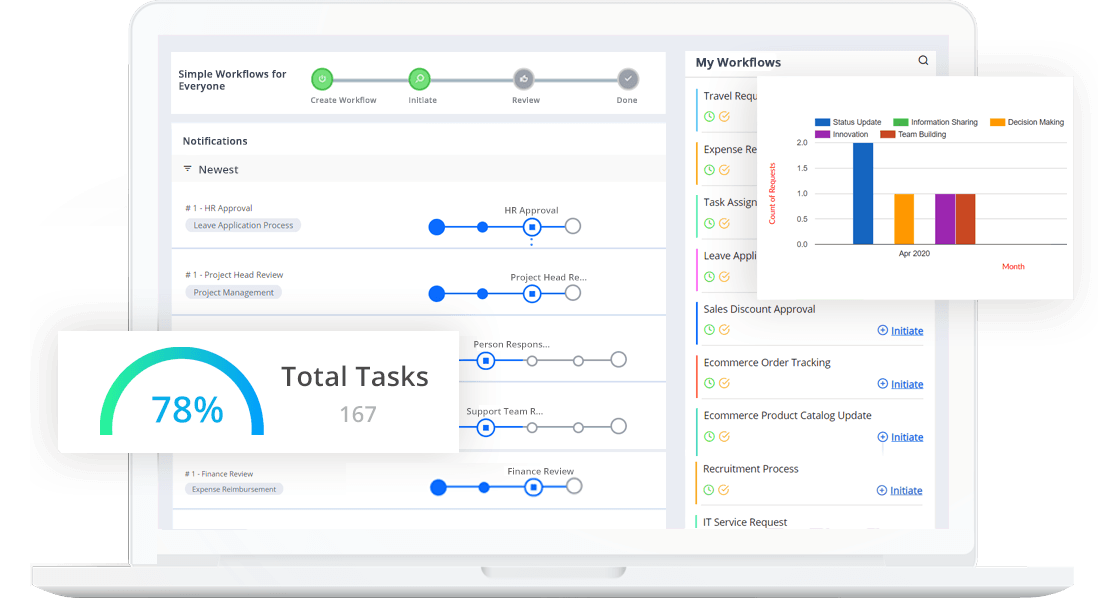

Choosing a workflow automation solution like Cflow enables businesses to automate their key business processes easily and quickly. Cflow is a no-code BPM platform that automates business workflows like procurement, finance, accounts payable, invoice approval, CapEx approvals, HR, and IT operations.

Cflow provides several pre-built workflow templates from which you can choose the one that best suits your requirements. Users can also create their own customized workflows using the visual drag-and-drop form builder. The visual form builder creates workflows based on process flowcharts. The document management feature in Cflow allows users to create, store, and update documents from a centralized console. The invoice approval process can be seamlessly integrated with other finance and accounting systems via APIs.

Here is how you can automate the invoice approval workflow with Cflow:

1. Creating an invoice template

Cflow provides a visual UI builder for creating invoice templates for business workflows. The invoice must provide complete details about the purchase and payment. The pre-built templates provide commonly used fields in an invoice. Users can customize the template based on their specific requirements. Commonly used fields on invoice templates include invoice number, client details like name, address, contact information, number of items delivered, payment amount, and remarks/comments if any.

2. Setting the approval workflow

Cflow is a customizable platform that is powered by an intuitive user interface that can be used by just anyone in the organization. Simple one-click setups in Cflow enable the creation of rule-based workflows for forwarding requests to another person or approving pending invoices.

The deep customization feature uses multiple conditions, operators, and operands, for automated approvals. The auto-approval feature makes it easy and quick to approve repetitive and non-critical tasks. With Cflow you can:

- Specify the primary approving authority and the secondary authority

- Set conditions for approval to be carried out

- Mention the next steps after approval of the invoice

Providing clear instructions on how an invoice is to be approved simplifies and streamlines the approval process. The automation of sales invoice approvals makes it super easy to push the invoice through multiple levels from the accounts team to sales leads, managers, and finally payout.

3. Setting conditions for approval

When specific conditions are defined for invoice approval, the flow is clear. With Cflow, you can choose to give selected access to the invoice so that only certain employees have access to it. Only stakeholders involved in the approval process need to be given access to invoices. Individual field access can also be defined in Cflow. For example, critical fields like invoice number, amount, etc, can be set as read-only for additional security. Users can choose the data they want to encrypt in the invoice so that sensitive information is safe from tampering.

Invoice approval workflows can be set up in a jiffy with Cflow. The business activity monitor provides deep insights into process times, bottlenecks, and inefficiencies. Setting up the invoice approval workflow with Cflow eliminates the chaos and streamlines the workflow.

Key Differentiators in Cflow

Why should businesses go for Cflow to automate their invoice approval workflows?

Cflow offers several features that simplify and optimize process workflows. Key differentiating features in Cflow include:

- Easily customizable workflows that can be set up within minutes. The drag-and-drop feature in the visual form builder simplifies workflow creation. Employees without a technical background can build workflows easily in Cflow.

- Quick and hassle-free onboarding of invoice approvers. The onboarding of new users or approvers can be easily done in Cflow.

- Automated notifications and alerts for pending approval. Approvers are automatically notified about any approvals that are pending from their side. Payment deadlines are always met when you are using Cflow.

- Public forms feature that enables teams to expose their forms to a larger audience. This feature is useful when you want to gather useful information on website visitors.

- Best-in-class security for reliable data protection. Sensitive finance data is secured at 3 levels, static, during transfer, and when used by employees.

- Digital signatures for faster sign-offs. Files are automatically sent for signatures and signed in a secure environment.

- Seamless integration with other applications used by business functions. Cflow integrates with popular and essential third-party applications like SAP, Zapier, and other essential business applications.

Cflow combines data capture, automatic routing, integration capabilities, and contract management into a single platform. Invoice approval management can be handled exceptionally well with Cflow.

Classifying invoices automatically, extracting key information, validating gathered information based on business rules, and routing invoices automatically to approvers, are some of the capabilities that Cflow brings to the invoice approval process. The workflow automation platform enables seamless data exchange between other software like ERP and accounting solutions.

Benefits of Automating the Invoice Approval Process

Automating the invoice approval process offers several benefits to the business. Immediate benefits include relief for employees from mundane tasks and shorter approval cycles. A glance at the benefits of automating the invoice approval process.

1. Quicker approval of invoices

Automation of the invoice approval process eliminates repetitive and redundant steps from the workflow. This accelerates the approval cycle and enables quicker approval of invoices.

2. Increased employee productivity

Digitizing and automating invoice approvals save the accounts payable team from low-value tasks like chasing invoices, matching data with purchase orders, and ensuring the legitimacy of each invoice.

3. Lowers processing costs

Automation streamlines invoice approval, which reduces the processing steps. When the number of steps in invoice processing is reduced, the processing costs are automatically reduced. Moreover, the accounts payable team spends less time on each invoice, which saves time and costs associated with invoice processing.

4. Improves visibility of invoice status

Digitizing the invoice approval improves visibility across steps in the process. Each stakeholder is aware of the status of the invoice at all stages of the approval process.

5. Improves compliance with regulatory requirements

Automation brings about standardization across the invoice approval process. Standardization of invoice approval improves compliance with regulatory requirements.

6. Avoids late payments and penalties

An automated invoice management approval system issues automatic alerts and notifications to approvers for timely approval of invoices. When invoices are approved on time, payments are also processed on time. Penalties for late payments are avoided when the invoice approval process is automated.

7. Centralized access to invoices

All the invoices are stored in a centralized location for easy and quick access.

8. Improved vendor relationship

On-time payments to vendors strengthen vendor relationships.

9. Accurate documentation

The documents related to invoice processing are stored, maintained, and updated accurately. Digitization eliminates manual paperwork, which prevents any misplacement of documents.

Conclusion

An invoice approval process is an important part of accounts payable systems. Streamlining the invoice approvals relieves the accounts payable team from working on low-value tasks. Using workflow automation software like Cflow accelerates invoice payment approvals and ensures timely payment to vendors.

Paperless invoice approval systems improve the visibility and transparency of invoice approval. Errors in invoice processing, duplication, and fraud in invoice processing can be avoided by automating the approval workflow. The invoice approval process can be effectively automated with no-code BPM solutions like Cflow. To explore how Cflow automates invoice processing workflows, sign up for the free demo. to sign up for the free trial.