Streamlining the Accounts Receivable Process: Best Practices for Efficient Cash Flow Management

Efficient cash flow management is a critical aspect of any business’s financial success. One of the key components of managing cash flow effectively is streamlining the accounts receivable (AR) process.

The accounts receivable process encompasses all activities related to billing customers, collecting payments, and managing outstanding balances. By optimizing this process, businesses can accelerate cash inflows, reduce collection cycles, and enhance overall financial stability.

In this blog we’ll be exploring the best practices for streamlining the accounts receivable process, equipping you with the knowledge and tools to improve cash flow management within your organization. By implementing these practices, you can enhance operational efficiency, minimize delays in payment collection, and foster stronger relationships with your customers.

Accounts Receivable Process – An Overview

The accounts receivable process refers to the set of activities and procedures involved in managing the collection of outstanding payments from customers or clients for goods or services provided. It begins with the generation of an invoice or bill and extends to the receipt of payment and reconciliation of accounts.

The process typically includes tasks such as sending invoices, tracking payment due dates, following up on late payments, recording transactions, and managing customer relationships.

Accounts receivable is an asset on a company’s balance sheet, representing the amount of money owed by customers for sales made on credit.

The main aim of the accounts receivable process is to ensure that outstanding payments are collected promptly, thereby optimizing cash flow and maintaining healthy financial stability for the business.

Importance of Efficient Cash Flow Management

Efficient cash flow management is essential for the financial stability and success of businesses. It ensures that operational expenses can be met, financial obligations are fulfilled on time, and growth opportunities can be capitalized upon.

By effectively managing cash flow, businesses can navigate seasonal fluctuations, manage business cycles, and maintain stability during economic downturns. Also, it enhances the company’s creditworthiness, facilitating access to financing and favorable terms. Ultimately, efficient cash flow management provides the foundation for long-term survival, growth, and profitability.

Challenges of the Accounts Receivable Process

The accounts receivable process comes with its own set of challenges that can have a significant impact on cash flow management. Some common pain points and bottlenecks include:

1. Delayed Payments

One of the major challenges in the accounts receivable process is delayed payments from customers. Late payments can disrupt cash flow, leading to difficulties in meeting financial obligations and potentially causing cash shortages. This delay can be caused by customer payment practices, internal inefficiencies, or disputes over invoices or services rendered.

2. Inaccurate or Incomplete Invoices

Inaccurate or incomplete invoices can result in payment delays or disputes. Errors in billing information, missing details, or unclear pricing can lead to confusion and hinder the timely collection of payments. This not only impacts cash flow but also requires additional time and effort to rectify and resend invoices, delaying the collection process.

3. Manual and Paper-Based Processes

Relying on manual and paper-based processes for accounts receivable can be time-consuming, prone to errors, and hinder efficient cash flow management. Manually generating invoices, tracking payments, and managing customer accounts can lead to delays, data entry mistakes, and a lack of visibility into the overall AR process.

4. Lack of Communication and Follow-Up

Insufficient communication and follow-up with customers regarding payment deadlines and outstanding balances can lead to delays in payment collection. Without proactive reminders and clear communication, customers may overlook payment deadlines or prioritize other obligations, impacting cash flow.

5. Disputes and Discrepancies

Disputes and discrepancies related to billing, pricing, or service quality can lead to payment delays and impact cash flow. Resolving such issues often requires time and effort, as businesses need to engage in discussions, provide clarifications, or initiate dispute resolution processes.

6. Inefficient Collections and Credit Management

Inefficient practices can prolong payment cycles and negatively affect cash flow. Inconsistent credit policies, insufficient credit checks, and ineffective collections strategies can result in higher instances of bad debts, increased days sales outstanding (DSO), and lower cash inflows.

20 Best Practices for Improving Accounts Receivable Process

Process improvement is not a destination but an ongoing system of continuous analysis, issue identification, and change implementation. While the specific areas for improvement may vary depending on your unique accounts receivable process, the following checklist serves as a solid foundation

1. Enhance Security Measures for Your Accounts Payable Department

Implementing the best security measures for your accounts payable process is of crucial importance as it contains all your sensitive financial information. You can do this by setting up two-factor authentication (2FA). It requires all employees accessing the accounts payable system to use 2FA, which adds an extra layer of security by requiring them to provide a second form of verification which you can set it up to send a unique verification code sent to their mobile device for accessing the documents.

You need to ensure that all the software is up to date and educate your employees about security systems and common phishing attacks. Divide responsibilities such as invoice approval, payment processing, and vendor management among different employees to reduce the risk of fraud or unauthorized transactions.

Moreover, implement a robust data backup strategy to ensure that critical accounts payable information is regularly and securely backed up. This helps safeguard against data loss due to hardware failures, ransomware attacks, or other unforeseen events.

2. Switching to a Paperless Accounts Receivable Process

When you switch to a paperless process it offers several benefits. Firstly, you can eliminate the need for physical paper documents which reduces storage space requirements and the associated costs. By digitizing invoices, receipts, and other AR-related documents, organizations can streamline their operations, improve efficiency, and reduce the risk of document loss or damage.

A paperless AR process also enhances accessibility and collaboration. Electronic documents can be easily stored, organized, and accessed from anywhere with an internet connection, enabling remote work capabilities and facilitating faster decision-making. Moreover, digital records can be securely shared with stakeholders, such as customers, suppliers, and auditors, reducing the time and effort spent on physical document distribution and retrieval.

3. Mapping out your Accounts Receivable Process

Mapping out your AR process helps you to manage and track incoming payments better and it typically consists of several key steps.

Firstly, invoices are generated and sent to customers detailing the products or services rendered and the amount owed. Next, the company must monitor and track the invoices, ensuring they are accurately recorded and accounted for in the financial system. This includes maintaining a record of the due dates, payment terms, and any outstanding balances. Once the invoices are issued, the company engages in proactive collections activities, such as sending reminders or making follow-up calls to customers to ensure timely payments.

Upon receiving payments, the accounts receivable department reconciles them with the corresponding invoices and updates the financial records accordingly. This process may involve verifying the accuracy of the payment, applying it to the correct customer account, and reconciling any discrepancies. Ultimately, the goal is to effectively manage and optimize cash flow by minimizing outstanding receivables and ensuring timely collection of payments.

4. Implementing Automation

Implementing automation in your accounts payable department can bring numerous benefits, such as increased efficiency, reduced errors, and improved security.

Automation can involve various technologies, such as robotic process automation (RPA), optical character recognition (OCR), and machine learning algorithms. One key advantage of automation is its ability to minimize manual data entry and improve accuracy.

OCR technology can extract data from

- Invoices,

- Purchase orders,

- Other financial documents,

- Eliminating the need for manual input,

- Reducing the risk of errors.

RPA can be used to automate routine tasks like invoice processing, payment approvals, and reconciliation, ensuring consistent and standardized processes.

Additionally, automation can enhance security by reducing the potential for human error and unauthorized access. With automated workflows, you can implement access controls and permissions, limiting system access to authorized individuals only. Furthermore, automation allows for comprehensive audit trails and activity logs, making it easier to track and monitor transactions, detect anomalies, and investigate any security breaches or fraudulent activities.

5. Accounts Receivable Fraud Prevention

Preventing fraud and protecting your organization’s financial health and reputation is crucial. You need to implement robust measures to detect and deter fraudulent activities. This includes conducting thorough background checks on employees handling accounts receivable, segregating duties to ensure no single individual has control over the entire process, and implementing strong internal controls and monitoring systems.

Educate your employees about common fraud schemes, such as invoice manipulation, fictitious customers, and collusion, is essential. Establishing a culture of ethics and integrity, where employees are encouraged to report suspicious activities without fear of retaliation, can also help in detecting and preventing accounts receivable fraud.

By combining these preventive measures with regular reviews of policies and procedures, as well as keeping up with emerging fraud trends, organizations can significantly reduce the risk of accounts receivable fraud and protect their financial assets.

6. Evaluate and Optimize Vendor Relationships

Optimizing vendor relationships involves fostering effective communication and collaboration. Maintain open lines of communication with your vendors to ensure that expectations are aligned, and issues are promptly addressed. This involves evaluating factors such as the quality of their products or services, their reliability in meeting deadlines, their pricing structures, and their overall level of customer support.

By assessing these aspects, you can identify vendors that align with your business goals and standards. Once you have identified areas of improvement, establish clear performance metrics and communicate them to your vendors.

Optimizing vendor relationships involves fostering effective communication and collaboration. Maintain open lines of communication with your vendors to ensure that expectations are aligned, and issues are promptly addressed. By nurturing these relationships, you can create a win-win situation where both parties benefit from a mutually beneficial partnership, driving growth and success for your business.

7. Organize Vendor Data Effectively

Effective organization of vendor data involves implementing a centralized system or database to store and manage vendor information. This system should include essential details such as vendor names, contact information, tax identification numbers, payment terms, and any specific contract or agreement details.

It’s important to establish a consistent naming convention and categorization system for vendors to enable easy search and retrieval of information. Regularly review and update the vendor data to ensure its accuracy and relevance.

Consider integrating the vendor data system with the accounts payable software or enterprise resource planning (ERP) system used by the organization. This integration allows for seamless data flow between systems, automates processes such as invoice matching and payment processing, and reduces the risk of errors or discrepancies.

Also, maintaining a complete audit trail of vendor interactions, including communication logs, invoices, and payment records, contributes to effective organization and enables transparency and accountability within the accounts payable department.

8. Minimizing Data Entry Errors in Invoice Processing

Minimizing data entry errors in invoice processing is vital for ensuring the accuracy and efficiency of accounts payable procedures. To achieve this, companies can implement several strategies. Firstly, adopting automated invoice processing systems can significantly reduce manual data entry by capturing and extracting relevant information from invoices automatically.

Integrating invoice processing systems or accounting software can further enhance accuracy by automatically transferring data to relevant fields, minimizing the need for manual intervention. Regular employee training on data entry best practices and conducting periodic reviews of entered data can also help identify and address errors early on, leading to a more streamlined and error-free invoice processing workflow.

9. Timely Payments

Timely payments make a huge difference in your company’s financial health. You can implement payment reminders to ensure that invoices are paid promptly, reducing the risk of late or missed payments. By sending out automated payment reminders, you can effectively communicate with your customers and encourage them to fulfill their payment obligations on time.

Payment reminders serve as gentle prompts to customers, reminding them of upcoming or overdue payments. These reminders can be sent via various channels, such as email, text messages, or automated phone calls, based on your customer’s preferred communication methods.

By providing timely reminders, you demonstrate professionalism, reliability, and a commitment to customer satisfaction. This proactive approach can lead to improved customer retention and trust in your organization.

10. Negotiate Discounts

Negotiating discounts with vendors is a strategic process aimed at obtaining cost savings and favorable terms for the goods or services your organization procures. The negotiation process involves building strong relationships with vendors, conducting thorough research on market prices, and understanding the value your business brings to the vendor.

Effective negotiation techniques include being prepared with data and alternatives, clearly defining your requirements, and demonstrating a willingness to explore mutually beneficial solutions. The goal is to secure volume discounts, early payment incentives, bulk purchase benefits, or improved contract terms, ultimately optimizing procurement costs and strengthening your organization’s financial position.

11. Prioritize Invoices Efficiently

To prioritize invoices efficiently, start by establishing clear payment terms and communicating them to your customers. This helps set expectations and encourages prompt payment. Categorize invoices based on their due dates, urgency, and customer payment history. Focus on high-value or overdue invoices that require immediate attention, as they have a significant impact on cash flow.

When you have a systematic approach, such as aging reports, helps identify aging invoices and allows you to allocate resources effectively for follow-up actions. Additionally, consider offering incentives for early payment, such as discounts or rewards, to encourage customers to settle invoices promptly.

12. Regularly Create and Review Budgets

Creating budgets allows you to set clear financial targets and expectations for your accounts receivable department. By estimating revenue and forecasting expenses, you can allocate resources effectively and identify areas for improvement.

A well-defined budget enables you to plan and implement strategies to optimize your accounts receivable process, such as setting realistic collection goals, monitoring key performance indicators (KPIs), and identifying potential cash flow gaps.

Moreover, regularly reviewing the actual performance against the budgeted targets is crucial for evaluating the effectiveness of your accounts receivable process. By comparing actual results with the budgeted amounts, you can identify discrepancies, pinpoint areas of inefficiency, and make necessary adjustments to improve cash flow and reduce outstanding receivables. This review process enables you to assess the effectiveness of your credit and collection policies, evaluate the performance of your accounts receivable team, and identify trends or issues that may be impacting your cash flow.

13. Improve Cash Flow Management

Businesses can explore other cash flow improvement strategies, such as controlling inventory levels to minimize carrying costs, managing overhead expenses, and assessing financing options like lines of credit or invoice factoring to bridge temporary cash shortfalls.

Businesses should focus on optimizing their accounts receivable processes. This involves establishing clear payment terms, promptly invoicing customers, and implementing effective collection practices. By closely monitoring and following up on outstanding invoices, businesses can accelerate cash inflows and reduce the risk of late or non-payments.

Effective cash flow management requires careful control of accounts payable. Businesses should negotiate favorable payment terms with suppliers and consider taking advantage of early payment discounts. By strategically managing payment schedules and optimizing cash outflows, organizations can maintain a healthy cash position and improve their working capital efficiency.

14. Setting up a Cash Reserve

Setting up a cash reserve is an important step in your financial strategy and planning. It involves setting aside a predetermined amount of money in a liquid and easily accessible account to cover unexpected expenses, emergencies, or cash flow gaps. The purpose of a cash reserve is to provide a safety net and financial stability during challenging times.

To set up a cash reserve, it is important to determine an appropriate target amount based on factors such as monthly expenses, income stability, and risk tolerance. This target amount typically ranges from three to six months’ worth of expenses. The funds should be held in a separate account, such as a high-yield savings account, money market account, or a dedicated cash management account.

Once established, the cash reserve should be periodically reviewed and adjusted to account for changes in financial circumstances and inflation. Having a cash reserve provides peace of mind, helps avoid high-interest debt during emergencies, and allows individuals and businesses to navigate unforeseen financial challenges with greater confidence.

15. Reconciling Accounts Periodically

By comparing and matching the balances between different accounts, businesses can identify and rectify any discrepancies or errors that may have occurred.

Periodic reconciliation helps to detect and prevent fraud or unauthorized activities. By cross-referencing financial records, businesses can identify discrepancies that may indicate fraudulent transactions or errors in recording. This includes instances of unauthorized withdrawals, duplicate payments, or discrepancies between recorded invoices and actual payments made. Prompt identification of such irregularities allows for immediate action to mitigate risks and investigate the underlying causes.

Regular reconciliation ensures the accuracy of financial information and provides a clear and up-to-date picture of the organization’s financial health. It helps to identify and rectify errors, such as data entry mistakes or omissions, ensuring that the financial statements and reports generated are reliable and trustworthy.

Also, timely identification and correction of errors also contribute to maintaining good relationships with vendors and suppliers, as any payment discrepancies can be resolved promptly.

16. Conduct Routine Audits of Accounts Payable

Regular audits involve reviewing financial records, transactions, and processes to ensure accuracy, efficiency, and security within your accounts receivable operations.

Audits of the accounts receivable process focus on verifying the completeness and accuracy of financial records, reconciling accounts, and validating the integrity of customer data. This includes cross-checking invoices, payments, and customer information to identify any inconsistencies or errors.

In addition, audits assess internal controls, such as credit approval processes, billing procedures, and debt collection practices, to ensure compliance with established policies and procedures. When you conduct routine audits of the accounts receivable process, it contributes to the continuous improvement and optimization of your financial operations.

17. Outsourcing

When you outsource your accounting receivable processes it has numerous benefits to businesses. By outsourcing accounting functions, businesses can leverage the expertise and specialized knowledge of professional accountants who are experienced in managing accounts receivable efficiently.

Outsourcing accounts receivable processes allows businesses to focus on their core operations while leaving the specialized tasks to accounting professionals. These experts can implement robust credit control measures, including timely invoicing, accurate record-keeping, and proactive collection strategies. They can also perform regular analysis and reporting to identify trends and patterns in payment behaviors, enabling businesses to make informed decisions and take appropriate actions to optimize their cash flow.

Businesses can also benefit from improved customer relationships. Skilled accounting professionals can handle customer inquiries and disputes promptly and professionally, ensuring that issues are resolved efficiently. This enhances customer satisfaction and helps maintain positive relationships, which in turn can lead to faster payments and improved overall financial performance.

18. KPIs

Key Performance Indicators (KPIs) are essential metrics used to evaluate the success of an organization’s objectives and processes. Regarding accounts receivable process improvement, several critical KPIs can help measure the efficiency and effectiveness of the process.

One of the primary KPIs for accounts receivable process improvement is the Days Sales Outstanding (DSO). This KPI can measure how many days on average a company takes to collect payment after a sale has been made. A lower DSO indicates a more efficient collection process and better cash flow management. Tracking DSO over time can help identify trends and highlight areas that require attention to expedite payments and reduce outstanding balances.

Another significant KPI is the Collection Effectiveness Index (CEI), which assesses the efficiency of the collection process in retrieving overdue payments. The CEI compares the actual collections to the total outstanding balance and expresses it as a percentage. A higher CEI indicates a more effective collection process, ensuring that outstanding invoices are collected promptly and minimizing the risk of bad debts.

These KPIs offer valuable insights into the effectiveness of the accounts receivable function, allowing organizations to identify areas of improvement and implement strategies to optimize the entire process.

19. Continuous Evaluation and Optimization

Continuous evaluation and optimization are critical for improving the security and efficiency of the accounts receivable process. Regular assessments and making necessary adjustments can enhance accounts receivable procedures to minimize errors, mitigate risks, and ensure timely payments. This involves periodically reviewing the effectiveness of internal controls, such as the segregation of duties, authorization protocols, and access rights. Also, optimizing the use of technology, such as automated invoicing and payment systems, can streamline processes, reduce manual errors, and enhance data accuracy.

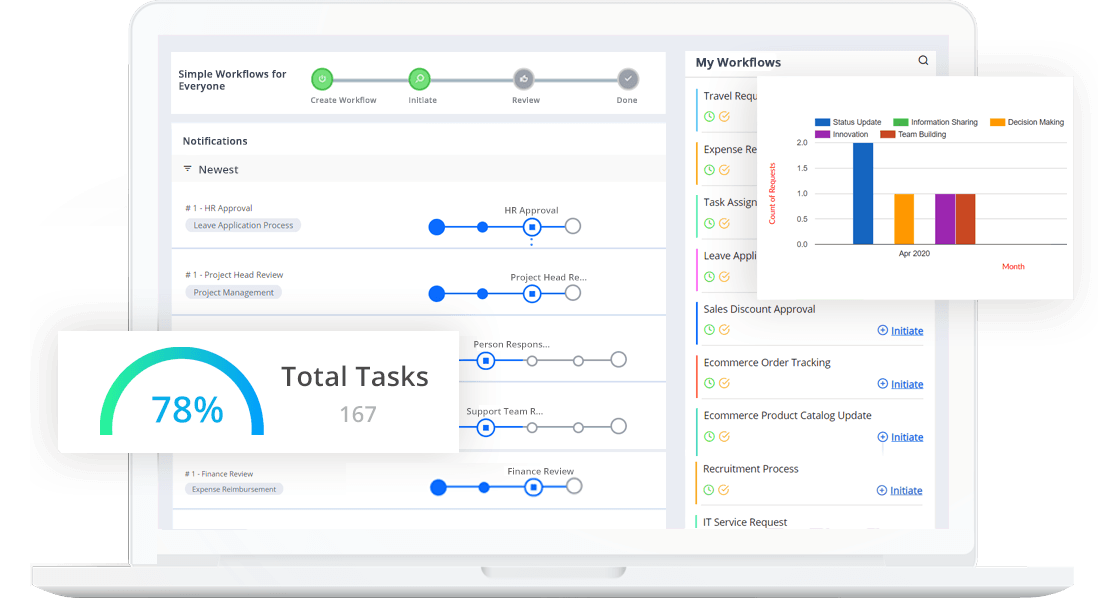

20. Utilizing No Code/Low Code Automation Tools like Cflow

Tools like Cflow can greatly enhance the efficiency and effectiveness of your accounts receivable process. By automating repetitive tasks, reducing manual errors, and streamlining workflows, these tools can help improve cash flow, enhance customer relationships, and optimize overall accounts receivable management. Here’s how you can leverage Cflow to drive accounts receivable process improvement:

- With Cflow, you can create customizable templates for invoice generation, ensuring consistency and professionalism.

- You can set up automated triggers based on predefined conditions, such as invoice due dates or specific customer actions, to ensure timely delivery.

- You can set up personalized email notifications to be sent at specific intervals, keeping customers informed about their outstanding balances and due dates. This proactive approach helps improve payment collection rates and minimizes the need for manual follow-ups.

- Integrating online payment gateways with Cflow allows customers to make payments directly from the invoice or through a secure payment portal. Real-time payment tracking and automatic updates within the system provide better visibility into payment statuses.

- Cflow enables you to design and automate customized workflows for accounts receivable processes. For instance, you can set up automated approval processes for credit limits, discounts, or payment terms. This eliminates the need for manual handoffs and improves compliance with internal policies and controls.

- Cflow maintains a detailed audit trail of all activities within the accounts receivable process. This ensures transparency, and traceability, and supports compliance requirements. You can track and monitor changes, approvals, and other critical activities, providing an added layer of security and accountability.

- Finally, the best is its scalability and flexibility. Cflow is designed to be user-friendly, allowing business users to configure and modify workflows without extensive programming knowledge.

Wrapping Up!

In conclusion, streamlining the accounts receivable process is crucial for efficient cash flow management. Embracing these practices empowers businesses to expedite payment cycles, increase cash flow, and achieve greater financial stability. With the aid of technology and continuous process improvement, organizations can streamline their accounts receivable operations, ensuring a seamless and effective financial management system. In addition, with the right tool like Cflow, you can effectively manage your cash flow.

Check out more about Cflow and Sign Up for a free demo today.