Automated Bookkeeping – Develop A Potent Workflow and Optimize Bookkeeping

Do your employees feel weighed down when dealing with the finances of your organization? Some organizations might have already implemented an automated bookkeeping process but have not been acquainted with its complete potential.

Bookkeeping is an essential part of any business and often has to be dealt with with utmost precision and patience. With an automated bookkeeping process, it has proven that organizations deliver more effective outcomes and broaden their scope.

Bookkeeping automation is a one-stop solution that would enhance financial dealings like data storing, integration with bank accounts, invoice generation and approvals, etc. Read further to gain a deeper insight into the bookkeeping process and garner how to effectively implement automation into the bookkeeping process.

What is Bookkeeping and Automated Bookkeeping?

Maintaining ledgers has gone far behind in time. With improved technology, more upgraded systems of finance management have been widely adopted. Bookkeeping is one such new and advanced replacement in the finance department. The bookkeeping process is maintaining a record of all the accounts of an organization.

Being part of the finance and accounting process, the inventory of accounts will also entail the different ways financial transactions are recorded in an organization. This logging of all accounts-related transactions will optimize and make your finances more effortlessly manageable.

An automated bookkeeping system is when the tasks within the process are streamlined and optimized using automated bookkeeping software. Automation brings so much to businesses’ hands. With workflow creation being one of the most effective attributes provided by automation, bookkeeping automation is achieved resulting in improved precision. Hence, automated bookkeeping is a crucial solution to adopt when organizations are aiming for maximum efficiency.

Workflow for Bookkeepers

The workflow of a process defines the series of tasks that go under any particular process. Most often, the workflows are represented in a flowchart fashion, that effectively leads the workforce into working in the right direction. The workflows can be of different types, based on the process, type of industry, and size of the organization, it can vary accordingly. Workflows are beneficial in streamlining the processes and eradicating all the limitations.

A bookkeeping workflow is a workflow that bookkeepers follow to streamline financial tasks and activities. The following elements would go into a bookkeeping workflow.

- Data entry is done by importing the data directly from client data.

- Financial paperwork and documentation management, like ledger updation, payment checks to pay invoices

- Management of books, auditing the different accounts, closing a book, etc.

Even for a single process like bookkeeping, there might exist different versions of workflows. Depending on the demands and criteria, the workflow elements and patterns might differ. Oftentimes, bookkeepers tend to use multiple workflows that might be assigned to different tasks within the process or pertaining to different departments.

In some cases, a single workflow of bookkeeping might not cover the entire organizational finances. For instance, they might have separate workflows to manage payroll, invoice processing and payment, and client-based payment processes and tax dealings.

Why do you Need a Bookkeeping Workflow?

A bookkeeping workflow is beneficial in several ways. When a workflow is designed and orchestrated to deliver the apt results for a process, the rapport between the workforce and the process/tasks is nourished well. Some important benefits that a bookkeeping workflow will offer are as follows:

1. Effective Project Management

With a huge number of tasks, managing a project is a hectic process. Hence, having a workflow will act as a framework for the entire process. With a defined workflow, the roles and responsibilities are laid out clearly, and the jurisdiction of their accountability is also clearly established. Such a system ensures the smooth and continuous flow of the tasks.

2. Clearly Defined Resource Usage

The efficiency of a process is said to be improved when the activities with it are streamlined with zero wastage of resources. This is achieved with the implementation of a workflow. An automated bookkeeping system will cut down the limitations like repetitive work that can be automated and the resources can be reallocated to a more complex task. In this way, efficiency is improved across levels.

3. Overarching Understanding of the Performance

With an effective workflow, there is better transparency followed by a better comprehension of the tasks within it. The process can be carried out more efficiently with clarity on what and how many resources must be deployed and the stipulated time for the given task. In such a system, the automated bookkeeping guides you to land on the right outcome.

4. Consistent Status Update

When a workflow is followed for any process, the employees who are part of the process will have instant access and updates on the progress of the process. After each stage of the process flow, the workforce can manually alter the status of that particular stage when done.

The Benefits and Drawbacks of an Automated Bookkeeping Process

Automating the bookkeeping process should not be a hurried decision to take. A clear vision accompanied by an outcome-oriented approach is a basic necessity for adopting such a shift. It is essential to know what it can offer you and also the disadvantages that tag along with it. First, here are the most common gains from automated bookkeeping.

Improved Efficiency

The ultimate goal of automation in any process is to improve the efficiency of that respective process. Even in the case of bookkeeping, automation boosts the proficiency of the process negating the possible drawbacks. The tasks that exhaust time and energy and repetitive tasks that do not require human attention can all be automated hence saving time and other essential resources.

Renders Real-Time Data

In a traditional setup of bookkeeping, the accounts and numbers are provided only when the bookkeeper has worked on it. But in an automated bookkeeping system, the accounting and the related data processing are all done instantly so that the other parties do not have to waste any time waiting. With the system done accounting, there is minimal chance of mistakes in data/number processing.

Better Process Better Outcome

Automation improves process performance which in turn catalyzes faster and better output. It helps you reach your goal faster and the catch is that all this can be achieved with fewer resources.

Minimal Errors

As mentioned earlier, the errors are minimized to a great extent. With the system taking care of all the tasks from data entry to data processing and approval and final insight generation, there is zero chance for any errors to occur.

It is important to understand that automated solutions are not always exact replacements for human judgment and skills. Therefore, setting realistic expectations is vital even when going ahead with automation. Now let us look at some of the drawbacks associated with automated bookkeeping.

Lacks Judgment

No matter the intelligence instilled in the computers or any system, there are always limitations associated with it. These systems could never reach a human’s judgment and sensibility level. Therefore, there are limitations when it comes to automation too. An automated bookkeeping system lacks judgment. Due to this, only repetitive tasks that do not require judgment can be automated.

Demands Human Initiation

The automation process is carried out based on the rules set in the software. These rules are constructed and established by a human. This proves that automation is not completely a no-human zone. The disadvantage is that the system will blindly follow the rules that are put into it and it will mostly magnify a minor mistake. Hence, the rules have to be orchestrated very diligently.

Requires Human Review

The involvement of a human is only removed within the process. Even when the process is completed, the process requires a finance professional to review and look for any errors and make the necessary changes.

How to Automate Bookkeeping?

Automated bookkeeping takes care of the most redundant manual processes that take up most of the resources without delivering the results. Hence, automating certain processes is essential for any business. Bookkeeping is one such process where there are repetitive tasks like data entry, review, and invoice approval.

Here are some effective ways in which bookkeeping can be automated.

Install an Accounting App

Having an accounting app/software will allow you to automate and optimize the bookkeeping process and elevate the functionality of the finance matters. There are certain tasks in the process that can be conveniently taken care of by the application. Some of them are

- Cash flow tracking

- Purchase order tracking

- Expense tracking

- Input transactions data

- Accounts payable process monitoring

- Accounts receivable tracking

- Payroll tracking

- Client invoice automation

Use a Payment Processors

Payment processors are essential in a business automation process. The payment processors can automate income transactions and make the compiling of the cash flow reports much easier. Additionally, the payment processors will also take care of the client billing and payment processing. It negates the delay caused in the payments and maintains the cash flow.

Link Business Accounts to the Software

Linking different banking accounts to one space makes the process simpler and saves a lot of time. Most businesses have debit cards and credit cards, with multiple bank accounts. Automating software will allow integration with external platforms like bank accounts and other payment-based applications. The transactions can be accessed and tracked together in one place. There is control generated in the payment activities, and the person in charge can monitor them anytime anywhere. Expenses are maintained within the stipulated budget allowing better cash management.

Manage Business Expenses Receipts

As a paperless transaction, the receipts and reports are generated instantly. Some of the automation software automatically generates receipts in the case of any transactions, while in others the users have to scan and upload the paper receipts and store them on the cloud storage system.

Tracking Service Providers

Service provider tracking can be a difficult task oftentimes. To manage these kinds of complex expense tracking automation platforms can be effectively used. Alongside using software, creating and maintaining spreadsheets can make it more efficient.

Payroll

Different automation tools offer different things. The automation that a business will choose must also be able to manage payroll. An automation tool for bookkeeping that will manage the payroll will be good surplus support over the automated data entry. Some automation solutions do this based on industries, taxes, or rewards, and some may also consider account laws and regulations.

Outsourcing through an Automation Provider

Sometimes, the automation solutions have to be hired by outsourcing from an automation service provider. For instance, businesses can build a team to handle outside experts. An outside agency can do the accounts for the business on a monthly, quarterly, or even yearly basis. When these external agencies work using automation tools, the work becomes more simple and tangible.

Businesses can either adopt automation software to ensure their finances are on track or go for an agency that would do the audit for them. It is always ideal to take support from an external factor to ensure stability and normal functioning.

Streamline Five Tasks with Automated Bookkeeping

With the several tasks that go into the bookkeeping process, is it ideal to know which tasks can be automated using an automated bookkeeping system. Here are some tasks that you can automate using automation software.

1. Transferring of the Bank and Credit Card Data

The workflow automation tool needs to be integrated with the banking details like debit and credit card details. This will allow the business to understand its cash position anytime. When automated bookkeeping is implemented, there is consistency that is brought in the transactions of the organization.

With such a system in place, any data can be drawn from the bank and the credit card accounts and can be stored in the accounting software. Using this feature, the transaction details can be matched across the finance tracking that you do aiding in the analysis and reporting of the finances.

2. Categorizing Different Transactions

Sorting and categorizing different transactions brings clarity and ease in handling. Machine Learning techniques can be used to do this sorting in automation software. Instead of spending a huge cost on a CRM Workflow, organizations can opt for an automated bookkeeping platform to sort and combine transactions according to different categories. This becomes crucial when businesses have to segregate low and high-volume payment transactions that are repetitive. Instead of doing this manually, automation software can do the sorting in an instant.

3. Dealing Accounts Payable Invoices

In a general scenario, the bookkeeper has to find the entry on the accounting software when the invoices come as mail attachments. This is followed by forwarding it to the manager for approval, and then finally filing the invoice for the audit. The entire process seems long and tedious. In an automated accounts payable process the software will automatically detect and categorize the attachments that are invoices or for review. Automatically, the system will match these details with the expense category and other supporting documents.

4. Filing the Receipts

Using automated workflow software will eliminate the need to maintain the track of paper receipts. The employees just have to scan and upload the receipts into the application. The system will automatically store the receipt in the cloud. The software is programmed to extract essential and required data from these receipts, and then they are added to the accounting software and saved the images of the receipts as well.

5. Managing Payroll

Manually calculating the payroll of your organization would be a laborious task, considering the laws and regulations, and the penalties associated with it. It is better to go for tools that give provisions to automate your payroll as well so that it will also erase any errors that may occur. Some tools have built-in payroll features and some are specifically built for payroll functions. This type of automation can also track the working hours of the employees and accordingly calculate their pay.

Bookkeeping Workflow Management

Bookkeeping workflow Management is the process of creating and maintaining an effective accounting workflow process for your organization. A bookkeeping workflow checklist will be developed for your organization, once the workflow is generated for the process. This workflow management will take care of all the tasks, from the data input to filing the tax documents. Hence, bookkeeping workflow management is essential.

Workflow Management for Bookkeepers – 6 Best Practices

To land at maximum efficiency when using an automated bookkeeping workflow for managing finance is important to any business. Therefore, below are some best practices that can be followed to enhance and improve the workflow and save resources.

- Implement automated workflows

- Clear task delegation to your finance team

- Track the time taken for the tasks to be completed

- The dashboard must be customized according to your business

- Always integrate client portals

- Monitor the progress regularly

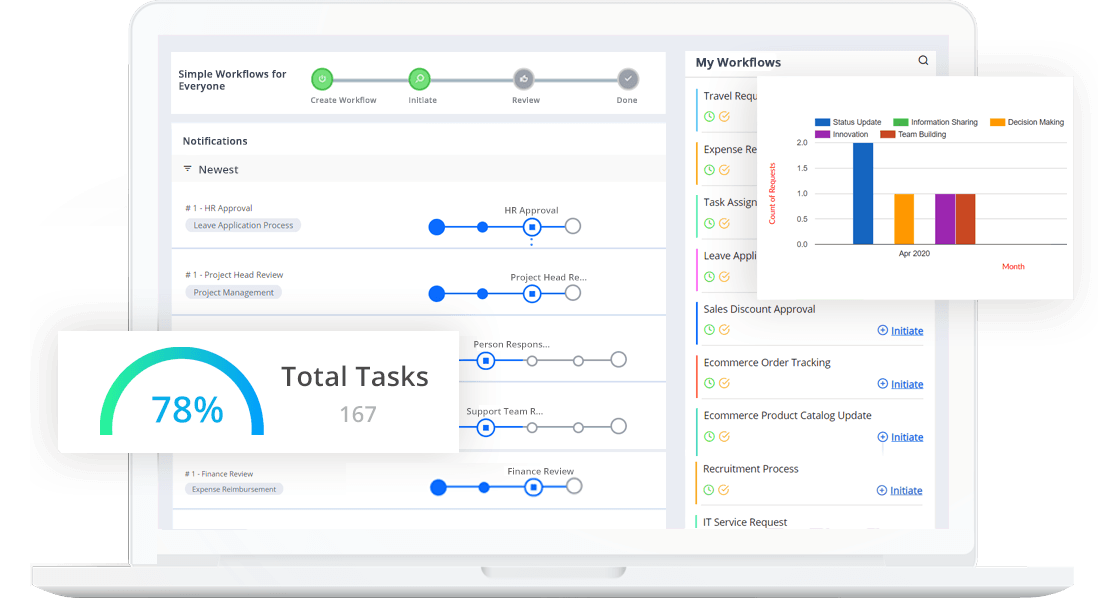

Automate and Enhance Your Bookkeeping Process with Cflow.

Cflow is a perfect automation tool that could effectively streamline your bookkeeping process. As an expert solution, Cflow will constantly improve your automated bookkeeping process. Our platform is a no-code workflow platform that every member of the team and the organization can effectively use.

Developed for managing businesses efficiently, our software readily offers you a clear set of task-based tools to help you gain the maximum benefits and deliverable outcomes. It also provides built-in and customizable bookkeeping workflow templates. Cflow offers a space where you can collectively combine all of your financial transactions and successfully deal with the bookkeeping process.

Cflow is also a tool that is specialized in integration. It allows easy integration with 1000+ other business applications. With this feature, the business’s accounting software and other applications used for payment can all be integrated easily. This ensures a smooth flow of all the tasks and will naturally align the objectives of the process and the goals of the organization.

Conclusion

Even though bookkeeping is a traditional form of finance tracking process and something that has been put into practice for a long time, several limitations and inefficiencies tag along. With the rising industrial standards, organizations are expected to travel beyond the expectations of the customers. Hence, having an all-in-one solution is quite necessary. Eradicate all the drawbacks with our tool Cflow. Get started for free. Sign up now!