Handle your Finance like a Pro with a Bookkeeping Workflow

With your business constantly growing, it has become more hectic to deal with all the accounts and finances. This has created a need for a stabilizing system. No matter the size or the industry, your bookkeeping process needs to be carefully managed to avoid any form of bottlenecks that could lead to inaccuracies.

An automated bookkeeping workflow is what you need to save yourself from such a downfall. This article will help you understand the benefits of bookkeeping workflows and how you can effectively carry out workflow automation tools for bookkeepers. But before we dive into understanding a bookkeeping workflow, first let us understand what a bookkeeper does.

What is Bookkeeping?

The process of bookkeeping is maintaining an inventory of the accounts of an organization. As part of the finance and accounting process, bookkeeping also encompasses the different ways financial transactions are recorded. Since it is a crucial part of finance accounting, this is done with the utmost attention and precision. Hence, a bookkeeping workflow will streamline all of the finance process and enhance it.

So What Does a Bookkeeping Workflow Do?

A bookkeeping workflow entails a sequence of activities and tasks for any business’ financial undertaking. These business projects are broken down into simpler tasks which are delegated and assigned to different employees. Just like any other workflow, a bookkeeping workflow will gather all information about the tasks that need to be done in one place. This will make it easier for all the team members to have access to the tasks’ updates.

A bookkeeping workflow will also let the members know what they are assigned and the estimated time to complete the task. The managers or the team leaders will be able to monitor each level within the workflow and determine its progress.

The streamlining of the process reached its efficiency because the activities within the tasks were divided. This streamlining will cut down on repetitive tasks like monthly bookkeeping that is done after every month.

A bookkeeping workflow ensures proper responsibility and accountability. If any confusion or error arises, it can be easily addressed as the workflow will allow the users to know under whose jurisdiction the issue has arisen. Automation elevates the efficiency of such a workflow. By implementing an automation tool, all this can be done with zero delays and zero errors.

Steps in a Bookkeeping Workflow

Every accounting professional will understand the difficulties of managing bookkeeping manually. With so many client requests, payment approvals, and payment receipts, it can be quite a handful, and tracking these will be humanly impossible. Determining and understanding the steps in the workflow will help you optimize the process to a different level. With this approach, you can point out the steps that can be automated as well. Here are the important steps that go into a bookkeeping workflow if you have to manage the accounts within the organization.

1. Analyzing the Financial Transactions

The first stage in the bookkeeping process is the analysis of the financial transactions of your organization after the last audit. Here a particular employee is assigned to analyze each of the transactions and other financial dealings that have been undertaken by your organization.

2. Classifying Them to Specific Accounts

The second step is to categorize these financial deals into specific accounts. These can be classified based on the amount, according to clients, or even classified based on the departments. This will systematize the process and in case of any confusion or queries, all the team members will know whom to approach.

3. Writing Credit and Debit Amounts into Appropriate Accounts

The next step is to jot down these transactions as credit or debit entries and specify the accounts involved. This will emphasize and give clarity on the amount that has been paid or that has been received by your organization.

4. Transferring the Entries into Ledger

The categorized entries can be transferred into the ledger. Most companies often tend to maintain a sub-ledger for vendors or other purposes. Therefore, the entries into ledgers can be made accordingly.

5. Adjusting the Entries of the Current Accounting Period

The adjusting entries become the final set of entries that are created toward the end of the accounting period. This will give an up-to-date status and accurate balance details for all the accounts.

A different workflow is followed by workflow service providers who take in other companies as their clients and manage the financial accounting.

This process has a different set of stages as described below.

Stage 1: Receive Request

The first step is the reception of requests from your clients. The request will initiate the bookkeeping workflow in motion. So, in this stage, the request is received and confirmed.

- Request from Client: In this initial step, The bookkeeping service providers will send out the request to their clients. A huge team is put behind managing multiple clients, therefore, precision is maintained without causing any delay.

- Reception of the Request by the Client: In this step, the clients receive the requests from the service provider. The final decision is taken by the client on whether to accept the request or not.

- Confirmation of the Request: In the third step of Stage 1, both the parties, the client and the service provider have to confirm the request that is initiated. During this stage, both parties will analyze whether the client’s expectations will be met by the service providers.

- Missing information: Most often, the client’s information might not be enough or some might be missing. Data cross-checking is done to find if any document is missing or insufficient. So, the workflow service provider can seek the necessary information.

Stage 2: Process and Fulfill

Stage 2 is where the complete processing, tracking, and accounting of the finance takes place. This stage is further divided into:

- Processing the information: Here is where the complete processing of the information collected from the document takes place.

- Review: The documents are reviewed to list out the necessary information. This review stage will point out if there are any errors or mistakes.

- Review by Client: By combining all the information collected for accounting, the client reviews the document as the errors have been removed. Here the client is made aware of the changes made so that both parties are on the same page.

- Info Missing: In most cases, information still remains incomplete or has been excluded by mistake. Therefore, cross-checking is recommended during this step before finalizing everything.

Stage 3: File and Follow-up

This is the final stage where the bookkeeping process is closed and the follow-up is done

- Final review and file: In this step, the final documentation is put through a final review based on which decision can be made, as a financial decision needs to be accurate to avoid any loss.

The Necessity of a Bookkeeping Workflow

Logging the financial transaction might sound simpler and easy to do, but in reality, the accounts person has to manage so many requests, projects, and clients simultaneously and is put under a lot of pressure.

To ease such a situation, a workflow will bring all the tasks into well-organized queues, making it systematic and standardized. In a traditional setup, to-do lists and spreadsheets might have helped to some extent, but in the era of advanced technology and the constant revival of it, continuing with the traditional methods will only hold you behind in this competitive industry.

Some repetitive processes like data entry, importing data, and reviewing documents often get delayed due to the lack of a proper communication channel.

A bookkeeping workflow will offer a space for the employees to assemble at the same level, where without face-to-face communication the status of the process can be gauged and they will automatically know what needs to be done. Therefore, a workflow will save time and resources. It reduces the confusion that could arise and minimizes the errors to zero.

Simple Ways to Start With Your Bookkeeping Workflow

A minimum level of planning and organizing must go behind anything you do, especially with finance. No matter the size of your organization, it is always better to have a systematic approach when dealing with your finances.

Proper planning and organization of your finances can help you save money, time, and other resources. Keeping these benefits in mind let us look at some simple measures you can follow as you slowly embrace the idea of a bookkeeping workflow.

Create a List of your To-dos

Every task that goes inside this process needs to be documented. This will help you make a list of your regular tasks. The list of the tasks and activities can also carry a small description of the things that go behind them along with the person/role assigned. This will create a common procedure for all the tasks.

A later option is that you can further break it down into smaller workflows like client workflow, tax workflow, or even engagement workflow. These can be further customized accordingly without affecting the main standard workflow.

If you are Dealing with Clients, make them a To-do List too

You and your clients are both equally responsible when it comes to the smooth running of the process. Creating a to-do list for your clients will be beneficial for you as it can guide them in the way you want them to go through the process. This will create a much deeper rapport between you two. Additionally, it will make it easier for them to do the tasks too. Your clients will have an idea about the overall process, and each step, making you both on par with each other.

Have Email Templates Ready

Dealings with clients will involve sending so many emails. Make sure that you have ready email templates so that you do not have to compose an email twice or copy-paste it time and again.

Managing the Documents In Order

Maintain the documentation you have already acquired. Ensure that the documented information is complete and sufficient. Even details of the tax filings dates and details and any other important and necessary information.

Maintain a Spreadsheet for your Team

It is essential to maintain a single spreadsheet for your team. All the important details can be updated in this spreadsheet so that it is easily available and accessible to the entire team. This way you can manage the workflow in a much more efficient manner.

Use an Automated Workflow

Instead of still going with paper-based documentation and tracking, allow your employees to enjoy the fruit of technology and automation. Automation can improve the quality of the work in a multitude of ways being the driving force of the process.

How can Automation Elevate Your Bookkeeping Workflow?

Automation is a technological advancement that has empowered most organizational processes. Finance being an important department, could benefit a ton when automated. A lot of pressure and demand is put into the role of an accounts professional, and this could trigger major issues like mismatching, details going unnoticed, or errors when entering data. Control is initiated with automation, and most of the repetitive and mundane processes can be removed from the workflow. This will reduce the risk of mistakes and unnecessary time wastage.

1. Approval Process is made Quicker:

There is a lot of communication that happens within the team in tracking and entering all the transactions followed by review and approval. This process goes across several employees which will result in delays and miscommunication. When an automated workflow is put to use, these communications are made much easier through the automation tool itself. Therefore, reviews and approvals are made much faster.

2. Accounting without Delay:

All of the repetitive tasks will be automated. This will save a lot of time in the entire bookkeeping. A lot of communication delay is also removed as mentioned previously. When acquiring the details from the clients is made simpler. The team does not have to request and wait till they receive it. In an automated workflow, the duties of the clients can be mentioned. This will allow them to know what documents they have to scan and upload. This will reduce the scenarios where documents are left out.

3. Increased Visibility:

The team members as well as the clients will have access to the bookkeeping workflows. Both ends can track the status of the process that is in progress. This will maintain transparency with both parties and can easily raise questions for clarification.

4. An Expense Guide:

An automated system will act as an excellent expense control guide. It will help you monitor the movement of cash within your organization and help you manage money in a much better way.

5. Increased Accuracy:

Automation’s main attribute is its ability to ensure accuracy in the process. Most often spreadsheets and other management accessories might not be efficient enough to drive the workflow’s accuracy. So many drawbacks are associated with the manual entry and processing of data.

Hence, an automated bookkeeping workflow will enhance the efficiency of the entire process and catalyze the working of the organization in general.

6. Elevated Efficiency and Productivity:

The overall efficiency and productivity of the organization. An optimized workflow will generate much better results when compared to a manual setup. There is an overall increase in the efficiency of the financial handle of your business. This is because the tasks are streamlined and almost all of the limitations are removed.

7. Cost Reduction:

Since the entire process is shifted to the online mode, there is a visible cash reduction in the complete process. When certain tasks are automated, it negates human involvement, which in turn saves labor costs.

8. Access and Trackability:

The status of the process can be constantly put under supervision. The employees who have access to the automated workflow can easily view and work accordingly. At the same time responsibility and accountability are nurtured in the work culture.

9. Bookkeeping Workflow Template:

Workflow management for bookkeepers is made much simpler with bookkeeping workflow templates. Pre-designed customized templates are available, where the employees just have to fill in the details of the tasks and the rules and regulations to the rules engine.

Ease your Bookkeeping Workflow Process with Cflow.

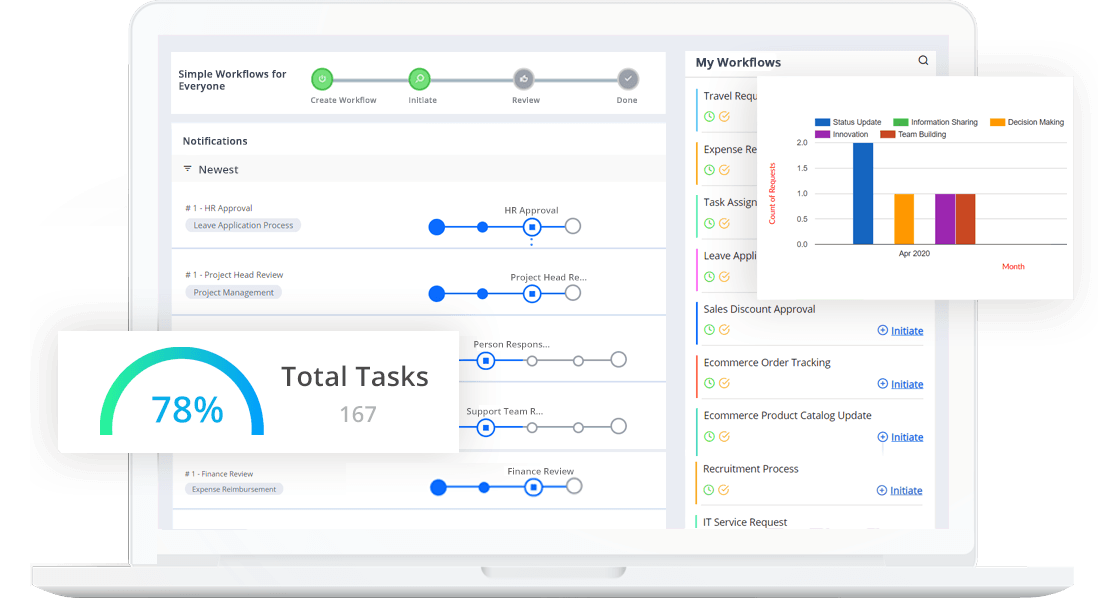

An expert solution is what you need when you decide to automate your bookkeeping workflows. Cflow is a perfect automation tool that could effectively streamline your bookkeeping process. Our platform is a no-code workflow tool that can be even used by a non-technical person. With the business-oriented features, it offers you a clear set of task-based tools to help you gain the maximum exposure with our platform.

It promises a space where you can collectively combine all of your financial transactions. Cflow gives a deep sense of clarity with its zero-coding nature which is crucial in the case of finance. Cflow is also widely known for its integrating feature. You can work over 1000+ other business applications without leaving the user interface. This will ensure that all the tasks run in sync with the objectives and goals of the organization.

Here are some of the best features that Cflow offers for bookkeeping workflow management:

- Using Cflow, you can easily create workflows with just a drag-and-drop action.

- The elements of the Control Center are visually appealing. These will make the workflow more vibrant and engaging.

- A huge variety of tools are available in Cflow which can be used to update your workflow after it is published.

- Pre-designed templates are already available for you. You also have the option to customize the workflow according to your needs and liking.

- Promises an effective review and approval of all the documents and information without any delays.

- Cflow encourages integration with third-party applications to effectively surpass your expected outcome.

There are numerous features that Cflow can offer that will make your workflow more intuitive and seamless.

Yes, Bookkeeping is a traditional and long-established form of finance tracking process. But in this competitive world and industry, the time has already come for you to leap over this old and customary setup to an advanced and efficient system of bookkeeping.

The advantages that come with an automated bookkeeping system are innumerable which will help in upgrading the image of your organization. Ambiguities and inadequacies are removed and a more precise, productive, and professional business culture is promoted. Get started for free with Cflow. Sign up today!