10 Best Accounts Payable Software Tools For 2023

Managing large volumes of invoices? Delayed payments & tumbling cash flow? Poor financial management? Not so good vendor relationship? – End such trends with accounts payable (AP) software.

Managing cash flow while building positive relationships with your vendors and customers is critical in business. Businesses use Accounts Payable software to streamline and manage both better cash flow and better vendor relationships efficiently. The financial transactions between you and your suppliers should be transparent and smooth to ensure a long-term positive relationship.

Accounts Payable is a crucial financial element that serves to be an indicator of good financial management. Companies buy goods and services for credit from the vendors and need to pay them within a short duration. These short-term obligations are referred to as accounts payable and are a company’s current liability.

Streamlining accounts payable systems is a must for any organization to ensure proper financial controls i.e. ensure paying debts/correct payments on time to the correct vendors. Human errors in such crucial business activity might cost you millions so software for accounts payable automation is the go-to choice here. The right accounts payable system setup optimizes your cash flow securely and efficiently while keeping your vendor relationship intact and healthy.

This blog takes you through knowing the importance of the right accounts payable systems and also lists down a few best accounts payable management software options available in the market.

What is Accounts Payable Software?

Accounts Payable software is the tool/solution used by the organization to manage their AP processes and functions. The accounts payable automation software encompasses the entire workflow for the AP process cycle and includes all accounts payable activities like tracking and processing the invoices to be paid to the suppliers or vendors.

Generally, the AP process involves functions like invoice verification, data entry, invoice scanning/payment processing, and vendor management. An accounts payable automation software automates these processes reducing the need for manual intervention, thereby reducing costly human errors.

The accounts payable workflows document the current liabilities of the organization and automate and optimize the spending and cash management of your organization. The accounts payable management software enables organizations to streamline their AP processes thereby improving their financial management with extensive reporting and analysis.

What is An Accounts Payable System?

Businesses of all sizes can make use of various software for accounts payable to control their financial activity with enhanced transparency and accuracy. Such environments that employ accounts payable software to manage the operations of the accounts payable department are referred to as the accounts payable system. Software for accounts payable can be a part of workflow management solutions already established in the organization like Cflow, while there are also other stand-alone options.

The accounts payable process involves:

Data entry

Dedicated teams are bound to gather required information from the invoices or other financial documents.

Reconciliation

Users are required to validate the information entered into their system by matching the two records i.e. Records are being checked for any discrepancies.

Payment processing

Timely payments save future disputes/misunderstandings. Ensure actions to make payments before the due date.

Updation

Users make sure that the payments done/due are updated correctly in the system so that they reflect the correct debts/credits in the cash flow statement.

The accounting software then records the data by imparting filtering, categorizing/ matching, and validating the collected information, to make a cash flow statement of an organization. Timely and accurate approvals are a must in the accounts payable process to avoid delays and business losses.

Make your payments/ debts cleared on time for your business relationship to be smooth and better, and streamline Accounts Payable processes.

The accounts payable in the company’s balance sheet show the sum of all outstanding payments incurred by the company and to be paid within a due date. The companies are likely to pay the debt as early as their due date as possible to avoid penalties and enjoy any discounts that may be offered for early settlements.

The accounts payable are referred to as outstanding/ debt in the company’s cash flow statement while it is the receivables in the supplier cash flow statement. The increase/decrease in the accounts payable from the prior year manipulates the business cash flow. If accounts payable is increased that means your business has bought more goods and services on credit compared to the previous year and the decreasing accounts payable indicates that the debt settlement/ payment is initiated at a faster rate compared to purchases made on credits.

The accounts payable system is used by startups, SMEs, and large enterprises to streamline their financial processes and improve their efficiency. Usually, an AP process is managed by the accounting/finance team or whoever is responsible for the financial management in an organization.

Why to Automate Accounts Payable Processes?

The prime goal behind implementing an accounts payable software is to facilitate seamless and efficient management of AP transactions, automating the process saves you time and money.

Accounts payable automation software allows you to streamline the complex accounts payable workflows imparting ways to achieve several other worthy goals, that impact the business bottom line apart from the specific purpose of managing accounts/financial transactions.

Automating accounts payable systems aids you in streamlining vendor payments, tracking expenses, and maintaining accurate financial records while adhering to internal budgetary constraints and compliance on both ends.

Any delayed payments will attract unwanted fines/ disputes with the suppliers. The accounts payable software keeps track of the due date and notifies the intended persons/team about the due date while highlighting the early discounts applicable if any. Therefore, automating the accounts payable system is required to avoid such scenarios benefitting the organizations by reducing the penalties or the chance of getting penalized.

The accounts payable systems are employed by any organization to have control over their finance or cash flow so that they can act proactively towards the payments/settlements in the near future to the vendors and also can anticipate any other cost-saving measures.

The insights are so intuitive in accounts payable management software that an organization using one can make decisions on the spend and expenses. The reports produced by the accounts payable automation software have a complete record of the cash flow over a particular period of time. Organizations analyze these reports quarterly or yearly and compare them to come up with decisions on cash ebbs and flows for the future.

In essence, the right automation tool for accounts payable management continues to improve finance control and develop advanced accounting practices while reducing the burden of accounting professionals.

Key Features of an Accounts Payable Software

- The accounts payable software aids you in keeping track of your financial management, facilitating a channel to clear all the debts/ outstanding vendor payments in an efficient manner. You can’t disagree that there are numerous stand-alone accounting software/tools in the market to do the job. But the real deal is choosing the right fit with the best features for your organization.

- The best accounts payable solution should also offer significant accounts payable features like reduced/automated data entry, and mitigated processing time/reconciliation period with easy and faster approvals.

- A tool that provides real-time tracking on a few aspects like- which bills to be paid? When is it due? Who is to be paid and how much? would be a go-to choice for an accounts payable software tool.

- The accounts payable software should be capable of handling large volumes of invoices and should extend its benefits for invoice scanning/ processing with OCR (optical character recognition).

- An efficient accounts payable automation software tool should be offering features that facilitate automated employer onboarding with electronic document matching thereby preventing any forms of fraud or breach.

- The best accounts payable software solution should track the due while it also should be capable of tracking early payment discounts and its optimization. The ability to integrate with secured payment platforms is more necessary than easy integration with accounts payable solutions. Tools also offer global payments supporting multiple currencies and payment platforms.

- The software for accounts payable management should automate payment approvals, payment reconciliation, and cash flow optimization. The tools for accounts payable management also should regulate the compliance measures adopted by the organization and the vendor/supplier in some cases.

- The AP workflows optimize the cash workflows in an easier manner by reducing the dependency on manual labour for tasks like data entry, reconciliation, and validation.

Top Choices for Accounts Payable Software

Cflow

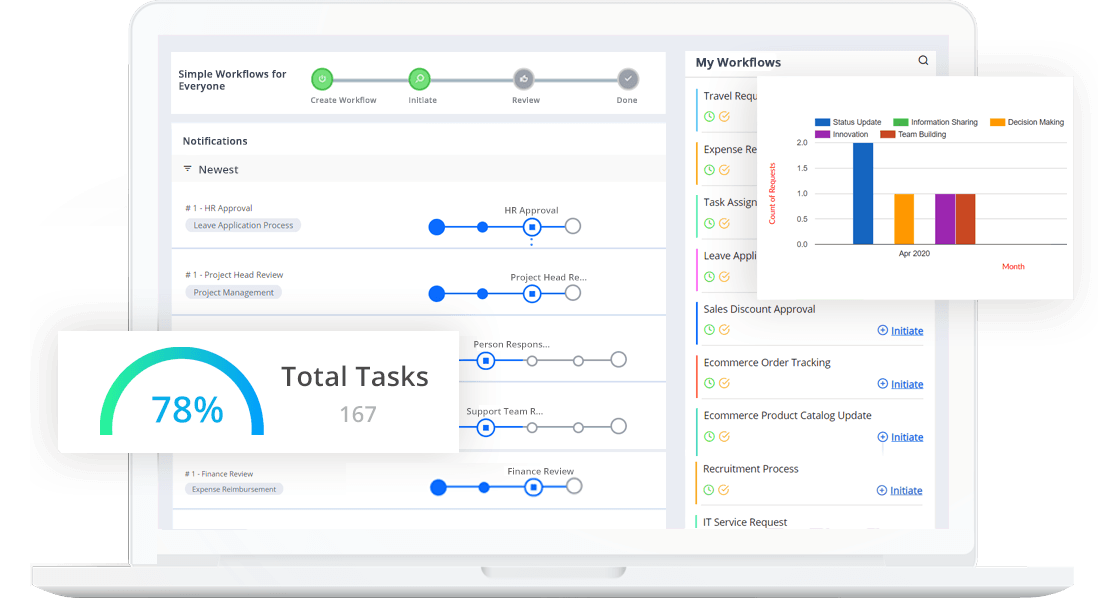

Cflow, the automation-first business model’s favourite, is a cloud-based workflow solution that provides the best features to automate your financial management and accounts payable process. The comprehensive set of features that Cflow boasts as accounts payable software is stealing the show as the usability copes with enterprise-suite automation.

The user-friendly interface, intuitive dashboards, No-code workflows, visual workflow builder, insightful real-time track reports, and ease of deployment and integration make it an ideal option for all business verticals and organizations. Extensive support and affordable pricing make Cflow stand out of the crowd. Cflow offers a 14-day free trial and three-tier enterprise suite pricing.

Stampli

The briefing is to clear out future mishaps! Faster approvals pave the way for faster payments is the approach of Stampli. This accounts payable automation software tool gears towards including the communication part at the top of their invoice template. This makes the intention of the invoice clear and helps to initiate the required action faster. This solution supports an AI bot, Billy which can even code and automate notifications. Stampli, without any doubt, is an advanced option for streamlining your accounts payable activities.

SAP

Whether your team is wide or narrow, or your organization is small, medium, or large, SAP has you covered as an accounts payable software. This is a comprehensive cloud-native accounts payable software that serves small businesses as SAP Business One and named SAP Business ByDesign to tackle the financial activities of a mid-sized organization. This tool is one of the accounts payable management software to set the competition on fire. Features like usage-based billing, insights by AI, automated payment reconciliation, and many others make this tool a user’s favorite.

Oracle Netsuite

The Oracle Netsuite is one of the popular accounts payable options that serve businesses of all sizes with varied business functions. This ERP system is high-end cloud-based and allows easy integrations and real-time insights. The dashboard of this tool is ideal for making business decisions as their reporting and analytics are top-notch accurate providing direct visibility. Automation platforms of other vendors can be integrated with the modules in NetSuite which imposes an efficiency surge in the suites.

Sage Intacct

This accounts payable software tool endorses automated accounts payable workflows and is the best fit for organizations that prioritize GAAP compliance and require multi-dimensional reports. Sage Intacct is AICPA-endorsed ERP accounting software and facilitates the usage of API. This facility allows users to customize their workflows without opting for other third-party APIs while getting one will improve Sage Intacct’s capability to streamline accounts payable processes. This tool is cloud-based and offers real-time accounts payable process tracking. Multi-dimensional reports views and approval reports are intuitive in the tool and this is a paid option.

Xero

Xero is a stand-alone cloud-based accounts payable automation tool that focuses on the AP process and its optimization. Xero is a complete and perfect fit for small businesses looking for accounting and AP processing activities. You can easily track the bills/invoices and the tool is known for its simple-to-use interface. The widely known Xero tool is church accounting software which provides all the tools to coordinate accounting processes within a church. It facilitates accurate audit trials forecasted by finance management workflows. It provides all tools to streamline the AP process starting from account record creation to reporting and also offers easy and faster tracking within the system.

QuickBooks Online

QuickBooks is one of the widely used accounting software for managing the functionalities involved in accounts payable systems. It offers seamless invoice management and is a go-to option for many small and mid-sized businesses to optimize their financial transactional activities. Payment processing and vendor management are so easy with QuickBooks Online since it is cloud-based. There is also a version dedicated to desktops and both offer easy integration with other applications as they support payments via numerous third-party payment platforms. QuickBooks offers a free trial for 30 days to get you started.

Spendesk

When you need control over your business spend and return, Spendesk is the winner providing complete oversight into your financial management. This automated accounts payable software is flexible, easy to use, and integrates as a full-featured accounting software. Faster account verification and invoice matching provided with synced reports make this tool an outstanding option for users. You can tailor the sync intervals based on your requirements and you can export and import data to an external software platform.

Epicor

Epicor is the best suitable account payable workflow software for thriving businesses as it is highly flexible and customizable. It offers both on-premise and cloud-based ERP solutions and includes IoT capability that finds its place mostly in procurement-based organizations. The IoT feature provides better visibility and tracking over end-to-end payables and is highly preferred by organizations with large teams.

Microsoft Dynamics 365

This accounts payable solution is the most familiar product of Microsoft and fits fine with organizations that are Microsoft-friendly. Dynamics 365 serves to be both CRM and ERP and integrations with other Microsoft products are not a big deal. It is widely used in all businesses and its familiarity is a boon to survive the new arrivals in the market.

Choosing the Best Accounts Payable Software

There can be numerous criteria like pricing, basic functionalities, general capabilities, specific features, ease in usability, and scalability to evaluate and find the best fit or the suitable tool. Other aspects like integration capability, accessibility, flexibility, cloud assistance, and many more to consider before getting an accounts payable solution implemented in your premises. Weighing such criteria depends on the business domain, legacy, and infrastructure.

So, here are a few questions that will prepare you for the process of analyzing and picking an accounts payable solution for your organization without any complexities.

- Understand the uniqueness of your invoicing module. Get to know how your accounts payable ecosystem is functioning.

- What is the format used in your invoices and what are the formats supported in your accounts payable landscape i.e. the formats for supplier invoices?

- How are the accounts matched and checked for reliability? What is the actual processing time?

- Does the current system use any workflow solutions? Can they be scaled to streamline the accounts payable process too?

- How are your suppliers onboard and what is their scope of visibility? Do they have access to your system?

- Does your environment support live syncing and tracking?

- Are there any measures to find the data deviations in the accounts payable process?

- Who has access to the document or are they stored in a central hub?

- What is the grade on flexibility and integration?

- What are the payment platforms supported and do they allow multi-currency payments?

Some solutions are known for their enhanced security while some excel with their real-time tracking. Some facilitate advantages like improving efficiency while few are best scalable. Research for redundancies and what causes the bottlenecks. Find the space for automation which is still done manually to avoid the loopholes.

So let’s do this checklist to know what to consider and what not.

- Invest in accounts payable software that allows multiple invoice formats, scanning methods, reconciliation techniques, electronic document matching, and automated approval workflows.

- Go for tools that support global payments and secured payment portal integrations. The tools should make seamless integration with your existing CRM and HRM or other software.

- Choose the one with automated invoice processing where the behind-scenes activities like receiving the receipts, data entry & storage, and reconciliation are also automated.

- Ensure the tool is flexible to collaborate with other departments through online and offline/centralized platforms. Do they comply with the internal and external policies?

- Pick one that has decent pricing and reviews. Know about their customer support and guidance provided before implementation. Do they provide demo and trial versions?

How Cflow Helps in Accounts Payable Automation?

With Cflow, you can tick all of the checkboxes above; additionally, we make your financial management more seamless with features of :

Centralized invoice payment/processing – as a cloud-based solution users can capture, digitize, and store invoices in a centralized repository.

Automated forms– you can automate filling out your forms for tax collection and other audits, as automated forms in Cflow populate the expected items as per the user-defined rules.

Dynamic approval workflows– we are cloud-based and offer a no-code solution to ease out your workflow creation with drag and drop interface.

Bottomline

Accounts Payable is a crucial part of finance management in an organization and making smart choices on the software helps you build stronger relations with your vendors. There are numerous powerful digital tools blooming in the market every day, choosing the best fit literally means your needs, requirements, business goals, and budget constraints.

Extensive research on a tool for its feature set, pricing options, and demo/support helps pick the best for your business. Cflow can be a compelling choice to make with its intuitive features and dynamic workflows. Empower your way of finance management with Cflow. Sign up for the free trial now.