Why, When, and How Can You Improve Finance Processes?

When you start a business you need financial backing, as the business grows you need streamlined finance processes for sustained growth and efficient finance and accounting management. Even a single finance process when not managed well can cause significant business losses. So how does the business manage its finance process?

Streamlining financial processes can be effectively done by using technology to automate key finance workflows. In this blog, we’ll explore some effective ways of making your financial processes more productive and list finance processes that benefit from automation.

Importance of Finance Processes in Your Business

Effective finance management is key to a business, right from the business seeding stage to the take-off stage to the resource maturity stage – every stage requires efficient management of business finances. Finance management plays a crucial role in the overall success of the business. The management needs to take continuous steps towards enhancing the finance business process to streamline finance operations.

A solid financial strategy plays an integral role in strategic planning and decision-making within the business. Financial strategy includes budgeting, forecasting, and financial goal setting It is important that financial objectives must align with the overarching business strategy. Including finance processes that focus on diversifying income streams and expanding customer acquisition within the overall finance strategy, accelerates business growth.

The roles played by finance processes listed below emphasize the importance of finance business processes in an organization –

- Assessing the financial situation of the business

- Allocating appropriate resources to projects/teams

- Assessing financial risk

- Managing cash flow

- Forecasting and setting future targets

- Controlling costs and profitability

- Optimizing tax expenditure

With such an important role in business growth and sustainability, finance processes need to be optimized and streamlined for better outcomes. A smooth-running finance function is a must for business success. Regular audits of the financial function and the processes help management gauge the effectiveness of each finance process.

Finance process improvement must be considered as an ongoing process rather than a one-time initiative. Even if the process improvement enables saving of one to five minutes per day in a finance process, this adds up to significant cost and time savings in the long run.

Also Read: 3 ways that this individual could improve

Common Challenges in Finance Processes

The precursor to finance process improvement is to first understand the main challenges faced by the finance function. We have listed some of the common challenges faced by the finance function.

Redundant processes –

Inefficient and outdated manual finance processes complicate and delay the entire financial cycle. Financial reports that are not in the expected format are difficult to understand and the team cannot derive useful insights from them. Redundant processes take a toll on productivity and stress out members of the finance team.

Utilizing intelligent and qualified finance professionals for performing low-value rote tasks encourages burnout and prevents them from applying their talents to productive tasks.

Unclear role division –

In manual finance processes, the division of roles and responsibilities is not clearly defined. This results in confusion and work not being completed on time. There is also a lack of ownership among the team members, leading to credibility and trust issues. Instances of mixed-up invoices or routing requests to the wrong personnel for approval are common when roles are not clearly defined.

Fraudulent practices –

Embezzlement and duplication are more common in businesses that rely on manual finance processes. Financial fraud is an ever-present threat that requires constant vigilance to foil cheating or duplication bids. The most susceptible areas of financial fraud are billing and accounts payable systems. Instances like invoices not matching expenses or duplicate bills being submitted are common in finance systems.

Information mismanagement –

The finance and accounting function handles mountains of information and documents. Handling such huge volumes of data can be overwhelming for the finance team, especially when they take the manual route. Proper management, storage, tracking, and organization of documents are extremely important to prevent misuse of information.

Added to this, these documents need to be maintained and updated, so that they are audit-ready. Recent research revealed that “misplaced invoices” and “invoices in paper format” were the biggest challenges faced by the finance and accounting departments.

Data entry inaccuracies –

“Zero” is of immense value in financial data handling. A wrongly placed zero in finance and accounting data can cost a business dearly. A simple mistake of an added zero to the billing amount can result in overpaid or underpaid invoices. When finance and accounting operations are predominantly handled by human resources, such errors are very common. Fatigue and burnout that result from manual data processing often lead to such mistakes or overlooks.

Delayed approvals –

A manual finance business process is prone to inordinate delays in approvals. The lack of clarity in role division in manual processes is further compounded by the lack of visibility in manual finance processes. The requestor and the approver are both not aware of the status of the claim or invoice PO, or any document that needs approval. Delayed purchase orders may result in projects running behind schedule, while delayed invoice approvals result in a disappointed supplier.

Misplaced documents –

The paper trail left by manual processes results in misplaced, missing, or even damaged documents. This is a common occurrence when there is a backlog of documents waiting to be processed manually.

For example, the absence of efficient accounting workflows may result in lost invoices that force the accounts payable department to waste precious work hours on requesting duplicate invoices from vendors. Leave alone asking for duplicate invoices, a lot of time is wasted on even finding out which invoice is missing. The auditing process is hampered by these missing documents.

Dissatisfied team members –

When finance and accounting personnel are forced to spend a substantial amount of their work hours on mundane activities, it leaves them unhappy and dissatisfied with their job. There are several instances when they may feel a yawning gap between the work they are doing and their capabilities and talents. A Gallup survey revealed that more than 50% of the employees who quit their jobs cited that neither their manager nor supervisor spoke to them about their job satisfaction 3 months prior to leaving their job.

All of the challenges discussed above provide more than one reason why you need a solid

Business process management system for finance and accounting processes. Several business process improvement techniques can be applied to improve the productivity and efficiency of financial processes.

How to Make Financial Processes Efficient?

Does the inefficiency of manual finance processes alone present a case for automating finance processes?

Not really, you need to watch out for several other indicators that warrant the need to streamline the finance process. Automating some of the key finance workflow processes is the most effective way of improving the productivity of the finance function.

Financial procedures differ in complexity and difficulty, ranging from complex tasks like financial planning and analysis to simple tasks like moving funds from one account to another. Irrespective of the type or complexity of the process, spending less time and less effort to complete the process is what every business desires.

We have listed some of the key ways of making financial procedures more efficient and productive –

Create Standard Written Procedures – Most tasks are independently carried out by members of the finance department. Having them execute tasks that are based on a set of written, standard procedures ensures that they follow the most effective way to complete each task every time. This ensures that individual members do not apply their own less efficient techniques to complete their work and follow optimal paths. Following written procedures is more efficient for the organization, and saves more money on labor costs.

Another benefit of implementing written guidelines for financial procedures is that training new staff members becomes easy. Rather than learning about the way the process works from disparate sources, it is easier and more effective to learn from written procedures.

Use a Centralized Account for Expenses – Business expenses like travel and food when staff members attend meetings and events in another location cause significant confusion for several accounting departments. Although, confusing and cumbersome employee reimbursement is a must for repaying an employee the right way. Rather than multiple accounts, maintaining a central account linked with a company credit card is way simpler for business owners. Having this arrangement along with spending limits on the company credit card ensures that employees do not overspend.

Organize Training Courses – Planning for thorough training of staff members on financial procedures followed by the company ensures that all processes are compliant with policies and regulations. Staff members must be prepared for all eventualities with a comprehensive training plan that covers all the worst-case scenarios. Although the training time might increase, it is well worth the additional effort because team members are adequately prepared for emergencies. If your staff is significantly experienced, internal training enables you to transfer present knowledge from senior members to new recruits.

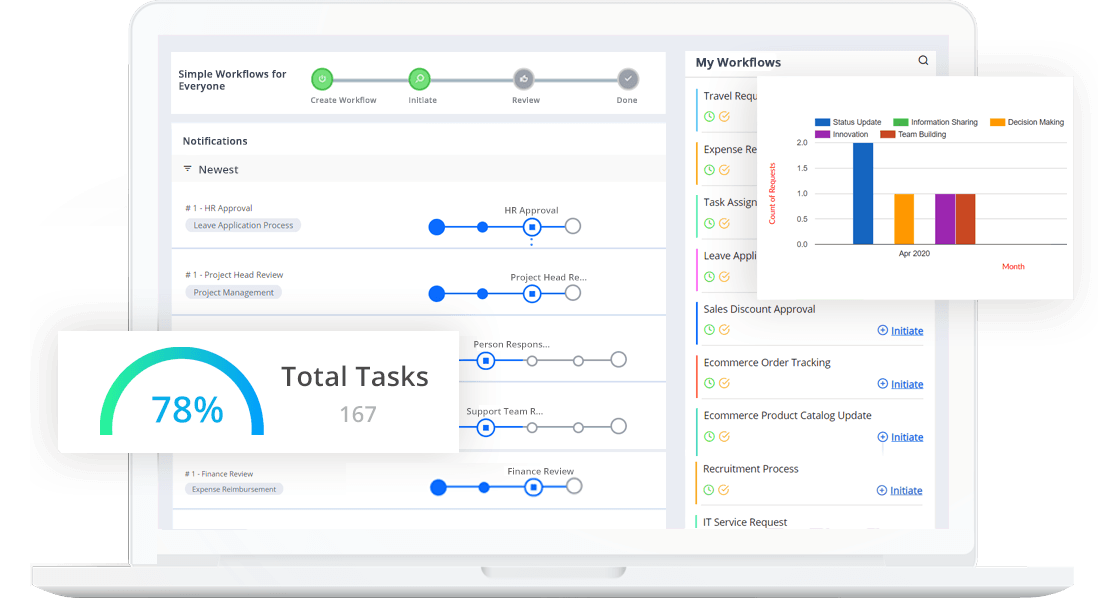

Implementing Software – Software and automation are central to the functioning of modern businesses as they help improve efficiency by eliminating redundancy and repetition. Implementing automation software solutions for improving financial processes helps eliminate human error, and data inconsistencies, improves reliability, and saves time and money. Workflow automation platforms like Cflow help automate key finance processes like invoice and accounts receivable, accounts payable, employee reimbursement, etc.

The main focus of finance process improvement is to make changes to financial workflow to increase efficiency. Finance process improvement examples could be as simple as creating more formalized guidelines to automate the accounts payable process. Using technology to automate your finance process has a positive impact on the consistency, speed, and accuracy of finance processes.

Why Should You Automate Finance Business Processes?

With so many predictable processes, why is it that it takes so much effort to complete finance business processes?

Manually handled finance processes are the main reason for the complexity of finance processes. The entire process of collecting/entering data, passing it on to the next staff, sending emails to get approvals, and notifying the initiator – everything is via human effort. Inefficient and unpredictable finance procedures are time-consuming and error-prone.

Working on these messy procedures can be demoralizing for employees with increased blame no accountability, and visibility into task statuses. Manual processes are breeding grounds for errors and inconsistencies. Tracking insights or data in finance processes that are manually executed is a challenge, and you are more likely to miss deadlines and delay internal or external reporting. Manual processes are also sluggish to react to the dynamic needs of the business. There are certain tell-tale signs that indicate the need for automating your finance processes.

We have listed a few of those signs below –

- Extensive use of complicated, error-prone spreadsheets

- Increased number of duplicated or redundant tasks

- Decreased visibility into task statuses

- Extensive manual processes with multiple instances of manual data re-entry

- Bottlenecks that stall the proceedings due to lack of access to relevant resources

- Lack of visibility into reporting

The best way to streamline finance processes is to automate the repetitive and low-value tasks in the process. Bringing order into chaotic financial processes may seem like a daunting task, but it can be done easily with workflow automation. Finance process workflows are made up of several repetitive tasks that need attention to detail and consume a lot of time.

When you automate a financial process, each of these repetitive tasks is taken care of by software systems. Automating repetitive tasks takes care of the rote work in finance processes. Humans take care of initially populating a form with data, and offer finance approvals, while rote tasks like sending emails, data entry, and notifications are taken care of by an automation solution.

A workflow automation solution like Cflow helps you implement finance process automation with minimal effort. By using automation solutions, employees can be freed from rote tasks and get time to focus on strategic financial work that adds value to the business.

How to Go About Finance Process Improvement?

Finance process improvement involves making changes to financial workflows to improve efficiency. Using technology to automate finance processes helps improve consistency, speed, and accuracy, which makes it easy for businesses to meet their goals. Here is how you can go about improving your finance processes –

Audit existing finance processes –

In order to improve the efficiency of a process, it is important to first examine the strengths and weaknesses of existing process workflows. Creating a clear map of the process helps you through process analysis. The main focus of process audits is to identify areas that can be made more efficient and cost-effective and decide which issues need to be prioritized over the others. Process improvement will prioritize areas that will deliver the most significant gains for your business and roll out additional improvements over time.

Involve key team members –

Before implementing process improvement ideas, it is important to get the team’s buy-in about the proposed changes. Getting team members on the same page helps build support for the changes you wish to implement across the finance function. Discussing the impact of these changes with all the stakeholders simplifies implementation and makes their work easier.

Train the team –

The best way to improve business processes is to provide cross-functional training to the team members. Training team members ensure that their knowledge and skills are up to date on accounting software and finance workflows. More importantly, training staff on optimal finance operations will free up time and make them comply.

Set clear deadlines –

A process with clear deadlines helps team members plan their work so that documentation is submitted on time. The likelihood of team members submitting expense claims and invoices on time is higher when they know that payments will be delayed if they don’t submit by the cut-off date. Setting up automated messages and notifications to individuals for submitting their documents helps enforce timely submission, and dynamic forms with rules help ensure that all fields are completed and supporting documentation is submitted on time.

Improve team collaboration –

The finance function does not work in isolation, it is often dependent on other departments for data. It is important to find ways to promote inter-departmental collaboration so that information is seamlessly shared between departments. Breaking down silos between various departments in the organization has a profound impact on process efficiency.

Automate key finance processes –

By automating key finance processes, you can significantly improve efficiency and eliminate chaos from financial processing. Choose to automate processes that are labour-intensive and have the highest risk of errors. Choosing processes that are performed fairly often helps you maximize time and cost savings. Routine financial tasks like purchase orders, invoice approvals, expense reimbursements, and other activities that people spend time on every single day several times, are ideal for automation.

Try to automate as many of these tasks as possible, and customize the automation settings to ensure that specific rules and controls are followed. Breaking core processes into smaller components reveals additional opportunities for automation.

Automate and Integrate –

Automating finance processes is a great start to process improvement. But, integrating the newly automated process with other parts of the system enables seamless communication between disparate systems.

For example, if the accounts receivable process is automated, then you should ensure that the automation tool interfaces with other tools like inventory management software. Most finance and accounting automation software facilitates seamless integration with other business tools via APIs and connectors.

Cflow is a BPM-based cloud automation tool that streamlines and transforms business processes quickly and effectively. HR and Admin, IT Operations, Finance and Accounting, and Sales and Marketing, are some of the key business processes that can be effectively automated by Cflow.

5 Finance Processes that Benefit from Automation

Automating key finance business processes improves the consistency and reliability of the process. You are less likely to lose any important and sensitive financial data by automating the process. Automation solutions backup data to the cloud, making it easy to retrieve it easily. However, not all finance processes are fit for automation. Some finance processes are better off with manual processing. You need to choose processes for automation carefully so that you derive maximum benefits from automation.

We have listed 5 finance business processes that can benefit from automation.

1. Purchasing –

Processing purchase requisitions and purchase orders (POs) is an important finance function for efficient and transparent procurement processing. Since multiple departments are involved in processing these documents, coordination can be challenging when you don’t have clearly defined workflows. Automating the purchase process simplifies the process considerably by allowing authorized employees to complete requisition forms and route them to procurement for approval. The automation tool also issues alerts and notifications to the concerned approver so that they are generated and sent to vendors on time.

2. Invoicing and Accounts Receivable –

Processing invoices and managing accounts receivable are important for ensuring a steady flow of revenue for the business. Both these tasks are time-consuming and prone to errors and inconsistencies, especially when carried out manually. Process automation takes care of the issuing, tracking, and reconciling of invoices, and the automated reminders to approvers. This makes the entire process simpler and ensures that they are completed on time.

3. Accounts Payable –

The accounts payable process is another good example of a finance process ripe for automation. This process is made up of numerous tasks like matching invoice data, sending it to the right person, and processing and recording the transactions. With these many tasks in the accounts payable process, the possibility of bottlenecks and delays is greater. Automation can streamline and standardize the process so that information capturing approval routing, and issuing timely reminders are done on time. Businesses can save money by taking advantage of early payment discounts by automating accounts payable.

4. Tax Compliance –

Typically, tax consultants are employed by businesses to take care of tax and regulatory compliance. This is not only costly but is also prone to delays. Non-compliance proves to be costly for the business, so much so that business licenses could be lost. Accounting software helps businesses take care of tax calculations internally.

5. Expense Management –

Managing company expenditures is a cumbersome process that frustrates finance teams. Reconciling company expenses involves gathering receipts, completing expense reports, reviewing and approving expense reports, and ensuring that employees get their expenses reimbursed on time. It is nothing short of a nightmare for everyone involved in the process. Automating the expense reimbursement process saves a lot of time for the finance team. The burden of reviewing data on the expense claims and validating it against the approved expense limits is lifted off the finance teams. With the labour-intensive steps automated, the speed of expense reimbursement is increased. When expense claims of employees are approved in a timely manner, employee satisfaction increases considerably.

Other processes like invoice matching, travel request approvals, employee timesheet approvals, CapEx approvals, and Budget approvals can also be effectively automated with workflow automation. A finance process that requires human intelligence is not the right choice for automation. Labor-intensive, predictable, and repetitive financial processes are prime for automation.

Conclusion

Most companies handle their finance business process manually. These processes involve a lot of human effort, which increases the possibility of error and bias. Finance processes that are made up of repetitive, labour-intensive tasks can be automated effectively.

Finance business process automation can be effectively done with the help of no-code workflow automation software like Cflow. The visual form builder in Cflow makes it super easy to create forms. You don’t require coding knowledge to create workflows, you can simply drag and drop relevant icons to create the process workflow. Workflows can be automated within minutes with our cloud-BPM automation software.

Simply sign up for the free trial and start building your finance workflows right away. Explore more features of Cflow, and sign up to know more.