A Strategic Approach to Automate Accounts Payable Process

If you ask an accounts professional to rank finance and accounting processes based on the complexity and tediousness, the accounts payable approval process is bound to top the list. The AP approval process entails several data validation and matching tasks that require attention to details, and accuracy.

Companies that use a manual accounts payable invoice approval process would end up spending long hours just validating and matching data, instead of focusing on work that adds value to the business. Explore how workflow automation streamlines the AP approval process through this blog.

What is AP Invoice approval?

The invoice accounts approval process encompasses all those steps followed by the accounts payable team to get the supplier invoice approved and paid. This process begins when the invoice is received from the vendor, and ends once vendor invoices are paid out. Let us look at each of the steps in the AP approval process individually.

1. Receipt of Invoice

Once the goods/services specified by the purchase order have been delivered, the goods received note is prepared by the buyer. Upon receiving the receipt of goods, the supplier prepares the invoice. The vendor invoice contains complete information on the quantity of the goods/services delivered, the cost per unit, and the total cost of the consignment delivered. The date and time of goods delivery may also be mentioned in the invoice. The invoice is either delivered by hand (in case of a manual process) or sent as an electronic invoice (in case of a digital process).

2. 3-way matching

Once the buyer receives the invoice, the details mentioned in the invoice are compared with those mentioned in the purchase order and goods received note. This step is extremely important in the AP invoice approval workflow because it ensures that the payment is done only for the goods/services delivered, and the supplier has delivered only the goods/services listed in the purchase order. Important step as it is, the 3-way matching is also tedious and data-intensive. Accounts teams spend several work hours just matching and verifying data manually.

3. Review of invoice

Invoices that are okayed by the 3-way matching process pass the data-verification step. The accounts manager is usually the one to review the invoice. If required, the accounts manager can verify the invoice with the procurement manager for further verification. The accounts manager reviews and approves the invoice and forwards it to the payments team. In case the invoice is rejected, it is returned to the supplier for corrections or modification. The accounts payable team clarifies data, prices, and items associated with invoices. Invoice confirmation ensures that the supplier is charging the client only for what the client benefitted.

4. Create an invoice in the accounting system

Invoices that are approved are included in the accounting system. Once the invoice is included in the system, an audit trail is created so that the team can keep track of the payments.

5. Pay the vendor

The approved invoice is moved further into payments. Processing the final payment to the vendor is the last step in the AP approval process.

Depending on the maturity of the accounts payable team and the procurement to pay cycle automation, either the full accounts payable approval process can be automated or a few steps in the process can be automated.

Why is Manual Invoice Approval, not the Best Option?

When the accounts payable invoice approval process is carried out manually, it can be quite a task for the accounts payable team to track and manage invoices. In addition to the additional costs that manual invoice processing involves, the incidence of errors and inaccuracies is also high in manual processes.

According to a 2020 report by Levvel, the average cost of processing an invoice ranges between $10-$15. Manual invoice processing can be tedious for the accounts payable team, as it eats up into their work hours. There are 3 main steps in the accounts payable process that add up to the cost of processing the invoice.

1. Invoice capture

The invoice is received from the supplier in the form of emails with downloadable attachments, or by invoices that are scanned. When invoices are sent to stakeholders, the additional step of following up with stakeholders for receiving invoices is also included. This process amounts to 20% of the cost.

2. Invoice processing and matching

Processing and matching invoice data with that in purchase orders and goods received notes, is a laborious process that requires keen attention to detail and high levels of accuracy. Most of the time, the accounts payable team might be looking up the PO against a spreadsheet managed by operations.

Even if the PO matches, the AP team needs to follow up with stakeholders to see if they have received the product in good condition. In case there is no PO, then the team needs to get approvals over email. Matching and processing of invoices is by far the step that involves high costs. This step amounts to almost 70% of the cost.

3. Invoice creation

Once the invoice is approved, the invoice is created in the accounting system. This requires high levels of accuracy in ensuring that data is as per the original invoice. This process entails the least amount of cost (10%).

Manual processing of invoices is not the best option for businesses mainly due to the cost and time involved in processing. The time taken to approve the invoice is a major factor in the overall time and vendor invoice policies. Manual AP approval takes more time and takes up a substantial amount of the work hours of the accounts payable team.

Aside from this discussion on manual invoice approval not being beneficial, another factor that we need to consider is the approval levels for every invoice. How many levels of approval does every invoice require? Do you need every invoice to be approved by a single approver? This depends largely on the compliance rules followed by your business. For example, some companies may be OK with 2-way matching, while other companies may mandate a 3-way match.

Failure to adopt effective accounts payable processes can adversely affect the company’s ability to process invoices on a timely basis. In the absence of a streamlined AP workflow, businesses are unable to leverage discounts or set clear payment terms with suppliers. Relying heavily on error-prone manual processes for approving invoices, POs, and requisitions puts businesses at a disadvantage. Another issue with manual invoice processing is over-, under-, missed–, or duplicate payments to vendors.

How to Automate the AP Invoice Approval Workflow?

The longer you wait to set up the AP invoice approval workflow, the more savings and cash-related cash flow opportunities you lose. The electronic accounts payable approval process on the other hand helps AP teams substantially reduce time by up to 80% in the AP and payments reconciliation process.

Automating the accounts payable approval workflow also speeds up vendor verification and validation of accounts payable invoices. Approval requests and status updates are automatically sent to the respective stakeholders through an automated accounts payable approval workflow. The workflow can be customized to include the 2-way or the 3-way invoice automation matching process, as per the compliance policies followed in the organization.

An automated AP invoice approval process makes it easy and quick to validate and approve invoices. Also, duplicate or error-prone invoices can be avoided by automating the accounts payable approval process. Let us go through the steps in automating the AP invoice approval process.

1. Centralizing Invoice Capture

The first step is to automate the invoice capture process so that invoice management is centralized. A set of standard procedures can be followed to capture all the invoices in an automated workflow. A centralized invoicing process helps the AP team stay updated on the status of invoices instead of having to chase each stakeholder for the status of invoices.

A centralized invoice process involves 2 main setups – one is setting up supplier invoicing policies, and the other is communicating policies to vendors. The first step defines a process to capture the invoices according to business rules. Rules like all suppliers must send invoices via email, setting up a separate email for invoices, and mandating a PO policy, are extremely useful in streamlining communication with vendors.

2. Electronic invoicing

Using electronic invoices eliminates the need for manually entering invoices into the accounts payable system. An automated AP system can be used for sending invoices, instead of emailing the invoice. If the invoice is issued against a purchase order, then it is automatically matched against the PO and sent for payment.

The manual effort required for matching is greatly reduced. It is important to bear in mind that electronic invoices do not work for all vendors. Implementing electronic invoices works best for large and high-volume vendors.

The volume and spending must be considered before choosing to enable electronic invoicing for the vendor. You should also check if the vendor has e-invoicing capabilities before zeroing in on the vendor. Once a vendor is chosen, you must implement and test the invoicing process.

3. Automation of PO and non-PO invoices

The processing of invoices with and without the PO is different. When an invoice is received with a PO number on it, it becomes easier to carry out the 3-way matching process. Automating the 3-way matching process saves a lot of time for the accounts payable team.

In the case of invoices without a purchase order, there are 2 ways to process the invoice. You could create a PO first and then process the invoice, Or you can route the invoice to the appropriate manager for review and approval. Automating this step significantly reduces approval time and provides a complete audit trail.

4. Set up invoice approval workflow

The invoice approval workflow is automated in this step, so you don’t have to manually follow up with employees for approvals. You need to clearly define what should happen if an invoice needs approval after the 3-way matching is complete.

There are 3 different types of workflows that can result from 3-way matching – missing receipts, pricing mismatch, and quantity mismatch. Missing receipts is a common issue faced in 3-way matching. It happens when the vendor sends an invoice, but the person who ordered the product has not received it or forgot to create it. When invoices are missing, they can elongate the invoice approval time. An automated flow can remind the employee to create the receipt.

Pricing mismatch occurs when you don’t have a negotiated rate with the vendor, and so they charge you the market rate. It can also occur when you are purchasing a volatile commodity, or you are purchasing custom parts. Negotiation with the vendor helps keep the cost fixed. A review workflow will be needed when there is a price mismatch.

Quantity mismatch occurs when the shipped quantity does not match the ordered quantity. The most common cause of this is a discrepancy in the unit of measurement. To resolve the mismatch, you will require a review workflow.

Set up tolerance levels – When you set up tolerance levels, it becomes easier to automate the process of approving invoice exceptions. This comes in handy when you are handling small price changes. Tolerances help in the auto-approval of the matching exception when the exception is within the tolerance limit. The amount and the threshold percentage control the tolerance matching.

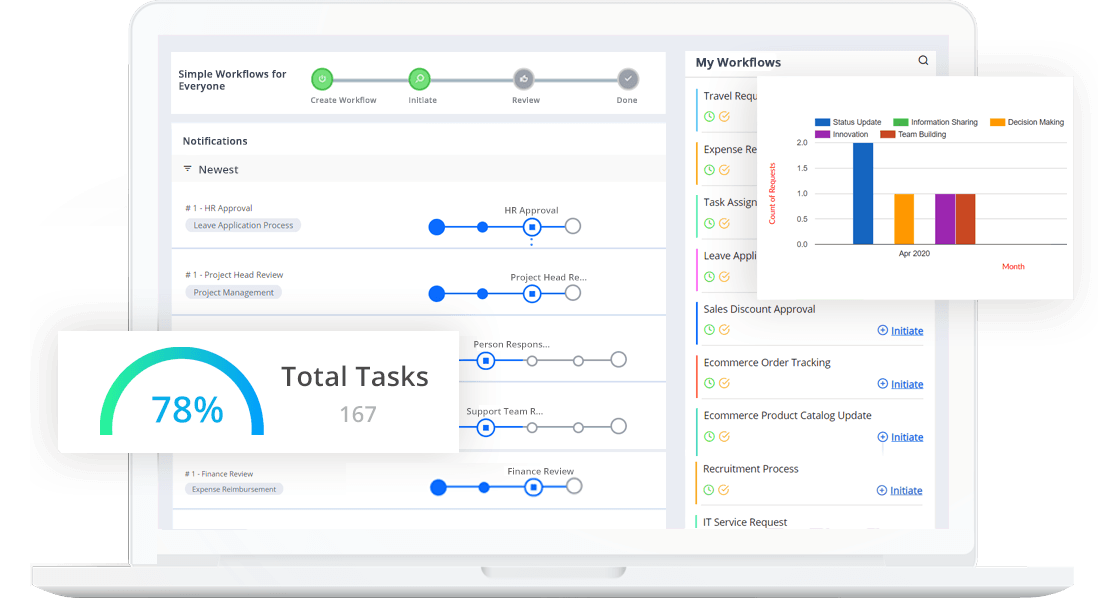

Invoice approval tracking dashboard – The final step in the AP invoice approval automation is implementing a central invoice approval tracking process. A centralized dashboard helps the AP team track invoices from one place. You can get a summary of all invoices along with their status. You can easily follow up on pending invoices with the overview provided by the dashboard. The dashboard also provides information on all the missing receipts so that they can be followed up with the respective stakeholders.

Integration with the accounting system – Automatic routing of the approved invoice to the payment system. Automating the routing of the invoice eliminates redundant data entry into two different systems. Once a single invoice is approved, an entry should be made into the payment system as well.

Best Practices in the AP Invoice Approval Process

Several accounts personnel have confirmed that they spend a substantial amount of time managing approvals. To think that they do this on a daily basis in addition to sign-offs from other employees or departments. This is a highly inefficient use of resources and causes much frustration to employees. Automating the accounts payable approval process is the best way to streamline invoice approvals.

We are listing some of the best practices in the AP invoice approval process.

1. Streamlining approval channels

Approval channels route purchase orders and expense vouchers to designated team leaders or managers. Payment is authorized once the designated approver signs off on the order. Creating multi-level approvals (at least 2) brings accountability and consistency in invoice approvals. Having separate approval channels for invoices and payments fortifies your risk prevention strategy, and prevents fraudulent approvals. Generally accepted accounting principles (GAAP) recommend segregation of duties for accounting best practices.

2. Automating approval channels

Organizations looking to implement a streamlined approval channel must consider automating the approval channels. An automated approval system prevents unauthorized access, customizes invoice routing, and helps create approval sub-sets.

3. Build a purchase order approval workflow

Creating a purchase order approval workflow entails setting up of internal rules before placing an order. The purchase order approval workflow can be created with a requisition for internal approval that is authorized by the manager of the finance department and then to the supplier.

4. Creating approval subsets

CFOs can create subsets or criteria for certain types of invoices. For example, an invoice can be designated as approved only after one of the two approvers has okayed it. Or the workflow can be modified so that an invoice is only authorized after all approvers have reviewed and approved it.

5. Institute formalized approval procedures

It is important that everyone involved in the process understands and follows the documented, formal organizational structure of the approval workflow. A clear definition of the approver, approval timelines, and secondary approver would in the absence of the primary approver be necessary for seamless invoice approval.

6. Customize routing

The invoice workflows are unique for every organization. Parameters like location, department, project, and vendor vary in every organization. Invoice routing must be customized based on the location, department, vendor, and project. For example, an employee working at a different location must be able to send an invoice to the head of the marketing team located at a different location.

Although geographically separated, the marketing head should be able to collaborate on the document and enter comments, or questions online without the need for a paper or email trail. Each invoice, therefore, will have a clear electronic audit trail of all the correspondence and approval steps.

7. Restrict unauthorized access

Finance information should be handled with utmost care and safety. Unwanted access to finance and accounting information can cause a lot of issues for the business. Role-based access must be given by the accounts payable invoice approval process so that only the concerned approvers can view the status and history of a purchase order.

Automating the accounts payable approval process can improve the financial stability of the organization. An automated system provides much-needed visibility into accounts payable by implementing paperless approval. You can make better business decisions through real-time access to financial metrics and KPIs.

Conclusion

Being a back-office function, the accounts payable do not always take centre stage. As a matter of fact, accounts payable takes a back seat due to management’s competing priorities. Although a backstage process, errors in the accounts payable process may cost the business dearly.

A streamlined accounts payable function, helps the business identify opportunities that yield substantial benefits. Cflow helps streamline the accounts payable approval process so that invoices are paid on time and without any discrepancies in payments. To know more about Cflow and its rich workflow automation feature set, sign up for the free trial now.