An Ultimate Guide to Month-End Closing Process

Do you ever wonder about how to close your month-end accounting? Have you ever wondered about the intricate details of this process? Each month your business will undergo an accounting month-end closing process to identify discrepancies, verify business account balances, and generate monthly financial statements. This blog will help you with your first-hand experience on month-end close process.

What is a Month-end Close Process?

The month-end close process is an accounting procedure where all of the previous month’s company transactions are accounted for. This is generally done by your accounting team, which reviews all records, reconciles, and other relevant account information.

Why is the Month-end Close Process so Important?

Your company is like a machine. It has many moving parts. And like any machine, it must be properly shut down at the end of the day. The closing process is where you can ensure all the pieces are in their proper place and that the machine is ready to run smoothly for the upcoming days.

The month-end close process is the last step in an accounting cycle. It helps you to balance books, checks cash, and bank account and prepares financial statements. For example, if you are a CPA firm, then at the end of every month your clients will send their invoices to you. After getting these invoices from them, you need to regularly check that all transactions have been recorded properly in your accounting system before sending them back for approval or rejection.

At this point many small business owners find that they don’t have enough time left on their hands to take care of this task effectively because they are too busy with other things happening around their office e.g., dealing with customers and vendors, etc.

The month-end close process helps you to balance books, checks cash, and bank account and prepares financial statements. The month-end closing process is an important part of accounting because it ensures that all transactions have been recorded accurately so that your financial statements are accurate. This will help you make decisions by having accurate information about the business’s performance during that time period.

Month-end Close Process Framework

There are only three phases in a month-end closing process – before, during, and after. Doing this correctly will help you streamline the financial processes of your business effectively.

Before

Before you begin month-end close, it’s important to review the forecast and budget. This will give you an idea of what resources are available for the next quarter, as well as where they’re allocated. You’ll also want to review actuals from this past month so that you can compare them against your forecasts and budgets for future months in order to make adjustments where necessary.

Next, perform a variance analysis by region or department (or whatever divisions make sense). This will help show which areas of your business did better than expected and which ones didn’t do.

During

The monthly close process is a critical step in the accounting cycle. It provides an opportunity for managers to review and approve financial statements and other reports, as well as make any necessary changes before closing out accounts at the end of each month.

The following steps outline a typical monthly close process:

- Review the general ledger account balances from your prior month’s transactions for accuracy, completeness, and compliance with company policies

- Confirm that all sources of revenue are properly recorded in your accounting system; this includes invoices/bills paid within 30 days after receipt and credit card charges that have already been posted by your bank (but not yet cleared)

After

After the month-end close process is complete, the business owner can look at their financial statements and see how well their business did over a given period of time. This will help them make decisions about what to do next with their money, such as investing it or paying off debt.

The benefits of doing this include ensuring there aren’t any errors in your books which could lead to problems later on down the line – such as investors losing trust in them because they think something fishy is going on! It also allows businesses who are planning ahead for tax purposes to know exactly where they stand financially so they can make informed decisions about spending money now versus saving it until next year when rates might change etc.

Steps in the Month-end Close Process

The month-end close process is an essential part of accounting. It involves many different tasks, including reconciling bank balances, posting journal entries, and preparing trial balances. These steps ensure that your financial statements accurately reflect the business’s financial position at the end of each accounting period. Also, it helps prevent mistakes or omissions and provides information for monitoring future performance and making decisions about how well your company is doing financially.

1. Set Up Closing Dates and Define Month-End Close Procedures

The first step in the month-end close process is to set up closing dates and define month-end close procedures. Once you have a clear understanding of when your company’s financial statements are due, it’s time to create a process that will help ensure they are prepared on time.

Then record monthly expenses and income. Update accounts payable, accounts receivable and other financial statements. Reconcile your bank statements with the general ledger entries for the period. This lets you know if there are any errors in your books or if money has been added or subtracted improperly by someone else who has access to them (like an employee).

2. Reconcile Bank Balances

The bank reconciliation process is the same as the accounting reconciliation process. You must compare your bank statements to your general ledger, which means checking that all of your transactions are accounted for and reconciled. It’s important to do this because it allows you to ensure that there aren’t any errors in your accounts or on your bank statement before they are reported in month-end reports.

Bank reconciliations can be time-consuming, especially if you have a lot of transactions from multiple banks or if there were large deposits made during that period that need explanation (e.g., payroll). However, performing them regularly will save time later when preparing for audits or tax returns because no mistakes will go unnoticed until then.

3. Post Journal Entries

Post journal entries are used to record all of your company’s transactions during the period, including:

- Posting prior period adjustments (e.g., correcting errors).

- Recording accruals and prepayments (e.g., paying for inventory that hasn’t been received yet).

- Depreciation, amortization, and depletion expense (deducted from revenue).

- Deferred tax liabilities (accrued taxes due but not yet paid) or deferred tax assets (estimated future tax savings).

Then you need to update the accounts payable ledger and the accounts receivable ledger. Make sure that the correct amount is recorded and the correct date is recorded

4. Ready your reconcile accounts

- Check for errors and missing transactions.

- Check for duplicate transactions, which can occur when a transaction has been entered twice by mistake or if you’re using an automated system that doesn’t check for duplicates before posting the transaction to the general ledger account.

- This can also happen if a transaction was recorded in a different period because of an error in your accounting policy (for example, recording cash sales as revenue instead of expense).

5. Create a Trial Balance

To create a trial balance, you must first prepare to enter all of your adjusting entries. Then, you can use Excel’s AutoSum feature to add up each column of data and create a total for each account. After that, it’s time for some checks!

You should make sure that every transaction has been accounted for in the journal entries (including debit and credit transactions). You will also want to check whether there are any missing entries. If so, these will need to be added before proceeding with the month-end closing procedures. Finally, if there are any misallocated entries (meaning they were entered into the wrong accounts), these will need to be corrected as well so that everything balances properly at month’s end.

6. Check Your Fixed Assets and Petty Cash Fund

Review the fixed asset register to ensure that all assets have been recorded. Check the depreciation schedule to ensure that all assets have been depreciated. Check the fixed asset register to ensure that all assets are still in good working order.

To check your petty cash fund, you should:

- Determine the amount of money that’s in the account. You can find this by looking at a recent bank statement or checking with your office manager.

- Check to see if there are any outstanding checks that need to be paid before replenishing the fund. If so, make sure they’re written and signed by someone who has the authority to sign checks on behalf of your company (e.g., an accountant). As long as everything looks good, go ahead and write out new checks for any items that need replenishing – and don’t forget to sign them!

7. Prepare Statement of Cash Flows and Balance Sheet Accounts

This is an important step as preparing cash flow statements and balance sheets will help you know the funds available to each business unit. To do so, you must reconcile all bank accounts with ledger accounts.

Financial statements are used to communicate with stakeholders and to inform them about the business’s financial performance. They are prepared at the end of each accounting period, and they provide information that can be used by management to make decisions about how well a business is doing. Financial statements also allow investors and creditors who have lent money or provided goods or services on credit terms (such as suppliers) to evaluate whether they should continue doing business with you.

The three primary financial statements are:

- The income statement shows how much profit or loss your company made over a specific period of time (usually one year). You use this to compare actual results against budgeted figures so that you know whether things went better than planned or worse than expected in any given month or quarter;

- The balance sheet gives details about what was owned/owed by an entity at a particular point in time – often referred to as its ” net worth “. It’s important because it tells us how much cash is available within an organization at any given moment;

- And finally, there’s also something known as an expanded statement which includes things like accrued expenses payable etc.

8. Prepare Income Statement and Statement of Retained Earnings for the period.

You will prepare the income statement and retained earnings statement for the period. The income statement shows in detail all revenues and expenses for the period. It also includes an account called “net income,” which is calculated by subtracting all expenses from total revenues.

The retained earnings statement shows changes in shareholders’ equity during a period–for example, if there was no change in total assets or liabilities then this would be reflected on your retained earnings statement as well!

9. Review

The review is a key step in the month-end close process. It’s a time to look back on what you have done and how well it went, as well as an opportunity for learning and improvement.

- Review what you have done: Look over your work from start to finish, including all of your calculations, reports and documents created by other team members (such as accountants). This will allow you to see how far along each part of the process was when it was handed off to someone else or completed by another team member. You might notice something like: “I finished calculating all of our accounts receivable balances but forgot about sending out letters informing customers that their accounts were past due.”

- Review how well things went: Take some time thinking about whether this month went smoothly – or if there were any bumps along the way that caused problems later on in another area of operations (like accounting). Did anything go wrong? If so, can anything be done differently next time around?

10. Implement lessons

- What are the lessons you learned from the month-end close process?

- How will you implement them in your business?

- What will you do differently next time?

- What steps will you take to make sure you don’t repeat mistakes?

A good understanding of the month-end close process will help you manage your business better.

Tools to simplify your Financial Close Process

Financial close software tools are a necessary part of the accounting process.

There are many different types of financial close software tools available for use today, but it’s important to know what each one does before deciding which one is right for your company

- Account reconciliation management tools allow users to keep track of all transactions between different departments or companies in order to ensure accuracy during the closing period. These programs help ensure that no errors occur when recording financial information from various sources in one place at once. This can save time by reducing manual work done by accountants during this time-consuming process!

- Close task management and assignment allow employees within an organization who have specific responsibilities related to closing tasks (such as ensuring accurate records) to receive notifications about their upcoming tasks so they know where they need to focus their efforts before meeting deadlines set forth by senior managers within businesses today.

- Process automation. Automation is a process that can be used to reduce the time and cost of performing a task. The use of automation can help improve productivity, accuracy, and consistency. Automation is used in many industries, including healthcare, manufacturing, and financial services.

- Financial close processes are typically manual labor-intensive tasks that require significant human intervention before they’re complete. Process automation tools are designed to make these processes faster by automating them using techniques such as machine learning or artificial intelligence algorithms that perform specific tasks based on rules set by humans (i.e. when certain conditions are met). These tools then communicate with each other so they work together seamlessly without any need for human intervention during the execution

- Integration with accounting software. Accounting software is a crucial part of your financial close process. It’s how you keep track of all your numbers and make sure they’re accurate, after all. But if you use accounting software that doesn’t integrate with the financial close software you use, then it’s going to be more difficult to get through the entire process smoothly.

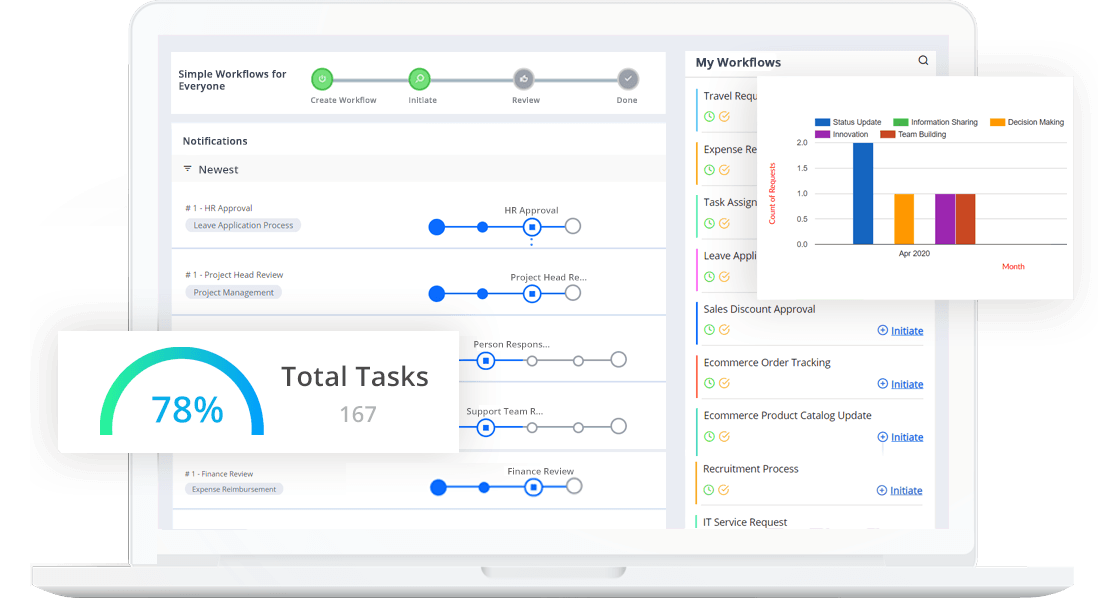

Here is how Cflow can help streamline your financial closings

Cflow is a cloud-based workflow automation software tool that helps you manage month-end close processes. that helps you automate the month-end process through intelligent bookkeeping. The platform helps you generate reports, reconcile accounts, and pay bills with minimal effort from your end.

With Cflow, you can:

- Plan your process in advance, so that you can work on it during the month.

- Automate your process and save time, by using Cflow’s built-in templates.

- Create reports to analyze your data, so that you can make better business decisions.

- Automate reconciliation with automated bank feeds

- Generate accounting reports in real-time or on demand

- Pay suppliers directly from your bank account

Wrapping Up!

Hopefully, this article has given you a better understanding of the month-end close process. The key takeaway is that there are many different steps involved in closing out the books at the end of each month. While some may seem simple, others require more time and effort on your part as an accountant or bookkeeper. However, with proper planning and organization (which includes knowing what needs to be done), any business owner can successfully complete this important task.